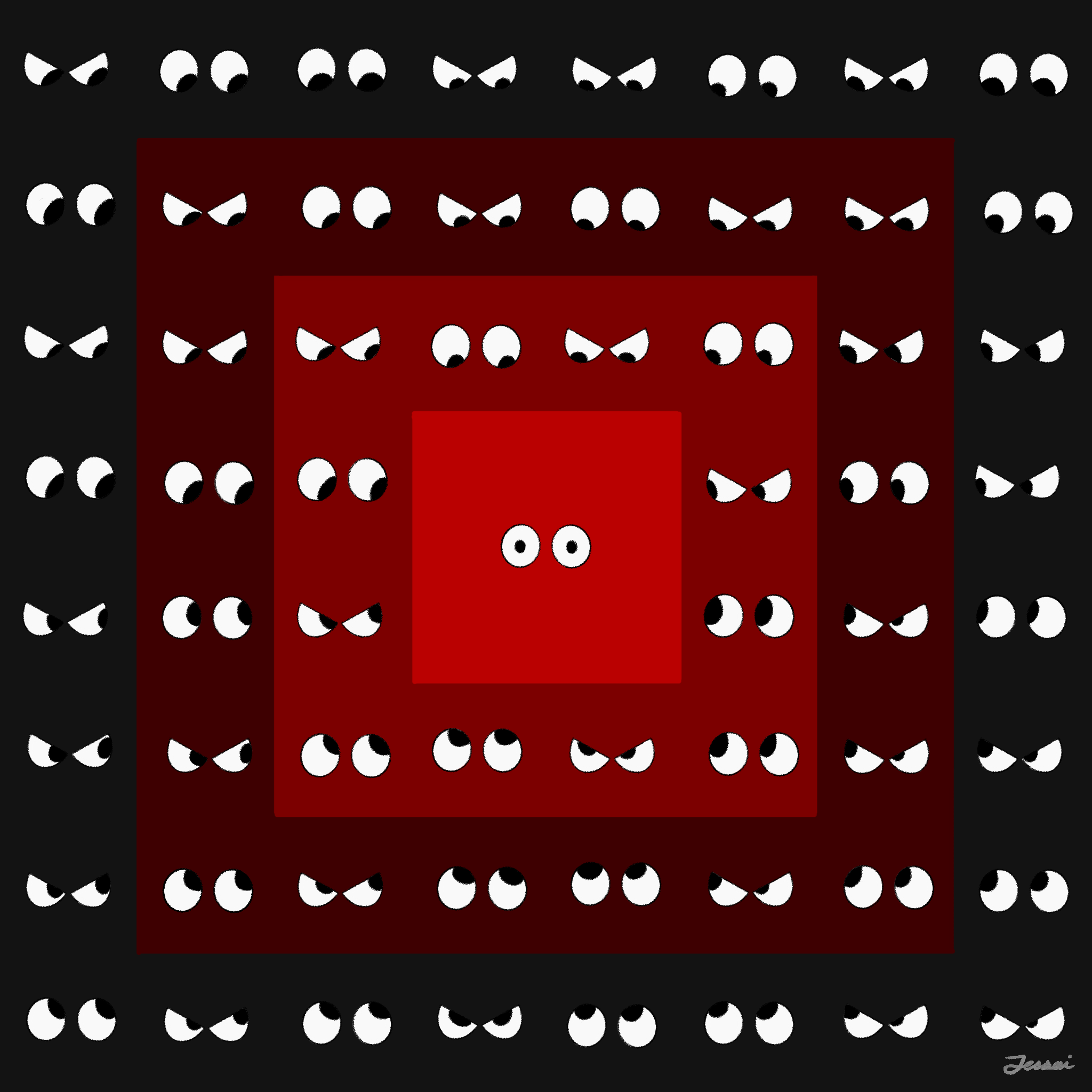

Jessai Flores

There is a liminal, almost inexplicable wind that comes with the start of sophomore year. People get busier, your big, codependent first year friend group slowly starts to wither away and you find yourself at the mercy of inevitable “let’s catch a meal” requests that yield no action. Scarier, and more intensely, a force sweeps away a good fifth of your friends and classmates: recruiting.

The heyday of first year, when you’re told by countless people — FroCos, deans and administrators alike — to explore and venture in all of Yale’s intellectual pursuits withers away meekly and is replaced ever so quietly by the allures of the finance recruiting process.

It’s no secret that finance careers have a way of pervading every academic discipline of this campus. As an HSHM major myself, I’ve had my fair share of conversations joking with friends about the fact that I “won’t get a job.” To which I’m always met with, “You can always go into banking. Goldman Sachs will never stop hiring.”

If you’ve yet to encounter the process, here’s how it typically starts.

Freshman spring: After experiencing one semester of life at Yale, students start being invited to information sessions held by firms. Yale is a “target school” with a strong alumni presence of people that have done well at these places. Alumni come back to meet the newest potential finance bros and host events at hotels like the Omni.

Sophomore fall: the dreaded “networking” phase. Peers who are currently recruiting describe this as a demanding endeavor because of the long hours spent cold emailing and tailoring resumes to current bankers, all in the hopes of scheduling a “coffee chat.”

Coffee chats, despite the inviting name, aren’t akin to meeting up with friends at Atticus, chatting it up for hours about god knows what and being surprised about how much time has gone by. The term has been co-opted for 15-20 minute calls where the prospective applicant hopes, in some charming but entirely replicable and mass-producible way, to establish a genuine connection with someone at the firm who can help them get their foot in the door.

Sophomore Winter Break: the “crucible” phase. While some of us are cozying at home, spending our winter breaks with family and friends, banking hopefuls sit anxiously at their computers, studying for dreaded technical interviews and preparing their resumes. Yep, applications for the next summer’s internships (yes, junior summer) are open. May the best ECON 115 student win.

Sophomore Spring: Hirevues, AI-powered video interviews where people record themselves answering questions start to commence. By February, those who manage to convey themselves best on video are invited to “Superdays”: day-long, back-to-back interviews at a firm in hopes of landing an offer. By March, the survivors will have locked in an offer at some bulge bracket or elite firm, while the losers are left to fight for consulting positions instead.

One of my classmates going through the process likened it to college admissions. Soul-killing in its emotional toll and the tradeoff between the time spent recruiting, as opposed to, say, spending time with friends.

Even with this aside, they remarked that it’s rewarding in the fact that the experience has helped them deal better with rejection and see the bigger picture of Yale.

I feel as though campus is rife with driven people who I continue to learn from every day, but it’s kind of bittersweet to watch people seem to lose their curiosity about the liberal arts in such an unforgiving process.

Me personally, I have HSHM stuff to do, but amidst all of the funding and hiring freezes for public health internships, it’s always on the back of my mind.