Supreme Court hears arguments on Biden’s debt relief plan

The Court debated the constitutional merits of a debt relief plan that could potentially waive federal student loan debt for two hundred thousand Connecticut residents in two separate hearings last week.

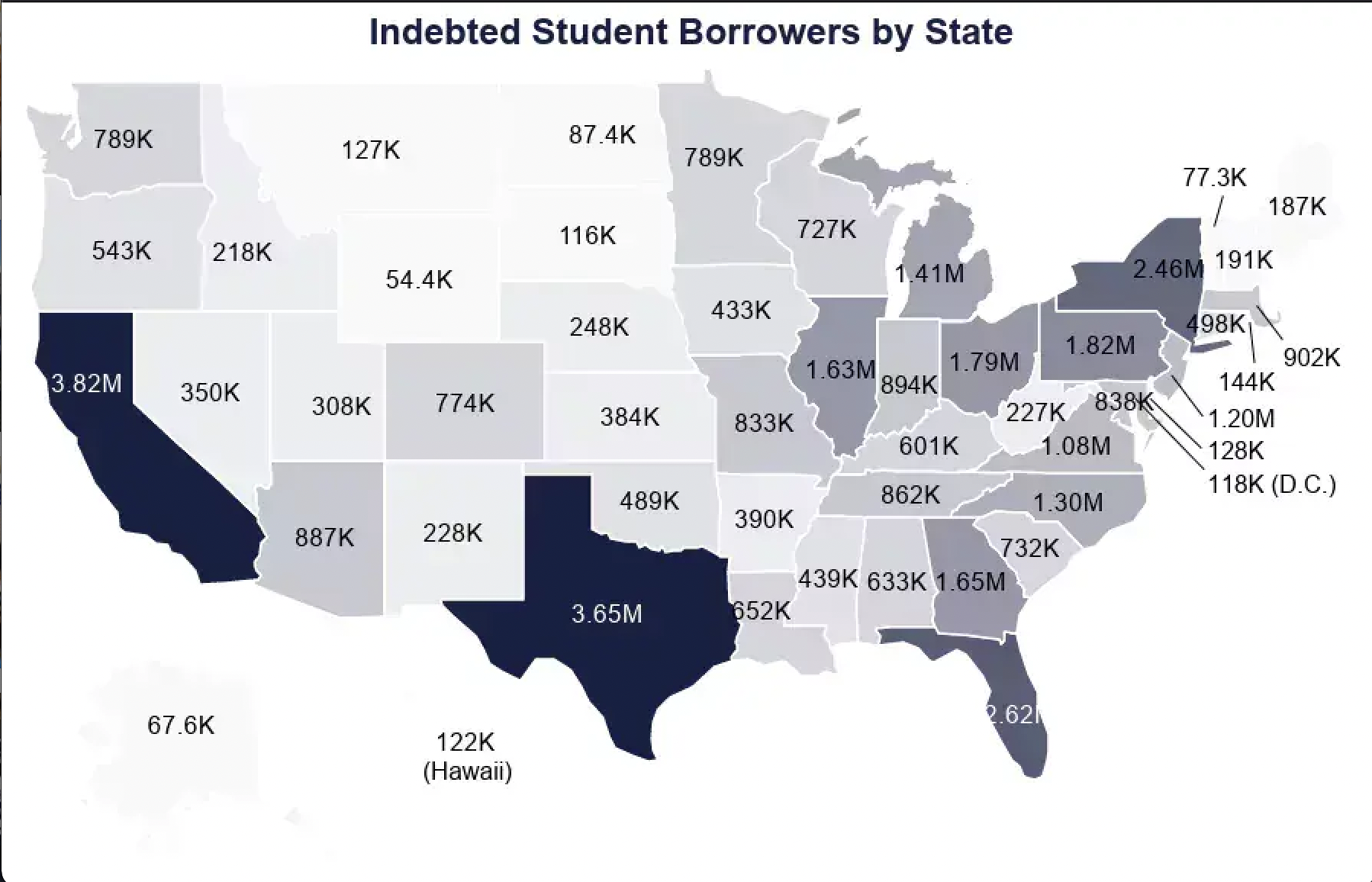

Education Data Initiative

The United States Supreme Court’s conservative majority reacted skeptically last week to two cases that will decide the future of federal student loan debt for two hundred thousand Connecticut borrowers.

The Biden administration’s debt relief plan, which was announced in August, intends to forgive between $10,000 and $20,000 in federal student loan debt for borrowers who meet certain income thresholds. But legal experts such as Linda Greenhouse, Yale Law School lecturer and senior research scholar, expect that the Court will block the plan by asserting that the executive branch requires more robust congressional approval. If the court’s decision aligns with Greenhouse’s prediction, 26 million pending applications for federal loan forgiveness nationwide will be declined.

To Greenhouse, in addition to statutory concerns about debt relief, the pending court cases reflect a growing “power grab” by the Supreme Court.

“The Supreme Court is bleeding power away from the executive branch and from Congress,” Greenhouse told the News. “Beyond the actual student loan question, that’s the importance of the case.”

Under the Biden administration’s plan, borrowers who earned less than $125,000 a year during the pandemic, or under $250,000 for married couples who jointly file taxes, are eligible for $10,000 in federal debt relief. The loan forgiveness amount doubles to $20,000 for borrowers who meet those same income thresholds and also received a Pell Grant in college.

Over 450,000 Connecticut borrowers were estimated to be eligible for at least $10,000 in loan forgiveness. More than half of that pool is eligible for $20,000 in relief.

More than 321,000 Connecticut borrowers applied for the loan relief or were automatically eligible, according to data from the U.S. Department of Education. Of that number, over 208,000 were fully approved. This number would have likely been higher if lawsuits filed against Biden’s order did not stop the administration from accepting relief applications.

Data from the department are further broken down by congressional district, revealing that Connecticut’s 3rd — which includes New Haven and houses Yale, Quinnipiac, Southern Connecticut State University, Albertus Magnus and Wesleyan universities — had the highest number of people across the state’s five districts who applied or automatically qualified for relief.

Connecticut is home to the fifth-highest number of students who graduated with debt, with an average of $35,000 owed per borrower. These figures apply to both undergraduate and graduate programs.

According to University student debt data from the Yale Office of Undergraduate Admissions, 88 percent of undergraduate students in the class of 2021 graduated with no student loan debt, while 12 percent had borrowed a student loan. Of the undergraduates that did borrow, the average student loan indebtedness totaled $14,383. These loans include both those provided by Yale and those provided by the federal government; the Biden forgiveness plan applies only to federal loans.

Nationally, 65 percent of graduating seniors borrowed an average of $28,650, according to a 2017 report on student debt from the Institute for College Access & Success.

Supreme Court hearing

The Court heard two cases related to the loan forgiveness program on Feb. 28. The first was Biden v. Nebraska, in which a group of Republican-led states argued that the administration exceeded its executive authority and used the pandemic-related national emergency to cover its true goal of fulfilling campaign promises.

The second case, Department of Education v. Brown, was initially brought by two individuals who did not qualify for the full benefits of the forgiveness program. They argue that the government failed to follow proper rulemaking processes while rolling out the debt relief program.

Greenhouse explained that the first case has two primary components to it: standing and statute.

“The question of whether states have standing to challenge federal policy has been heavily debated for a long time,” Greenhouse said. “For a long time, conservatives have said no states can’t sue, but the politics and personality of the Court have switched in recent years.”

In this particular situation, the liberal-leaning justices seemed inclined to determine that there was no standing, while the conservative faction seemed more likely to find it.

After last week’s hearings, Connecticut senator — and Democrat — Richard Blumenthal expressed skepticism about the standing of the Republican-led states suing the federal government.

“State AGs are seeking a special status on standing well beyond the most elastic solicitude for states’ rights conceivable to the founders or common sense,” Blumenthal wrote to the News, echoing comments he made on Twitter. “As much as I love AGs going to court, they get no free pass on standing.”

Blumenthal, who served as the attorney general of Connecticut for two decades, added that education in the United States should not have to be accompanied by “an ever-growing mountain of student loan debt.”

Regarding the second case, several justices — including John Roberts and Samuel Alito LAW ’75 — questioned the fairness of the Biden policy if not everyone can benefit.

“Why was it fair to the people who didn’t get arguably comparable relief, not maybe that their interests were outweighed by the interests of those who were benefited or they were somehow less deserving of solicitude,” Alito asked.

Fellow justice Sonia Sotomayor LAW ’79, challenged Alito’s line of questioning, noting an “inherent unfairness in society” due to limited resources nationwide.

As of Jan. 18, 21 state attorneys general filed a joint amicus brief in favor of the Biden debt relief plan in both cases, including Connecticut Attorney General William Tong.

In the brief, the attorneys general argue that under the HEROES Act — which was passed in May of 2020 to support economic relief in response to the COVID-19 pandemic — U.S. Secretary of Education Miguel Cardona has the authority to provide limited student loan debt cancellation to ease COVID-related financial hardships for students and families.

“These unaffordable payments delay many from buying homes, opening businesses or starting families, and from beginning to build wealth for themselves,” Tong said in a press release. “This relief is badly needed, and President Biden and Secretary Cardona were well within their authority to grant it.”

Larger legal context

Though the cases will directly impact millions of Americans and their loan applications, Greenhouse and Blumenthal both also spoke about the larger legal context of alleged overreaching by the Court.

Much of the discourse during the hearings concerned the application of the “Major Questions Doctrine,” a legal theory that the Court’s conservative members invoke to assert that Congress must specifically endow an executive agency with the power to enact a policy related to a “major question.”

Greenhouse called this doctrine “a newfangled theory that conservatives have made up,” noting that the definition of a “major question” is ambiguous. If the Court has unilateral authority to determine what makes a question major, Greenhouse said, this could lead to the Court holding an outsized amount of power compared to the rest of the federal government.

“As the Department of Justice argued last week, the major questions doctrine does not apply to this case,” Blumenthal wrote to the News. “This doctrine, which we’ve seen the Supreme Court use to invalidate the EPA’s regulation to spur more renewable sources of electricity, should not also be used to kill student loan relief for millions of borrowers who desperately need it.”

If the justices decide that neither party has standing in either hearing, the cases will be dismissed and Biden’s program will be allowed to move forward.

A decision is expected by late June.

Yash Roy contributed reporting.