Yale endowment return outperforms Ivy League

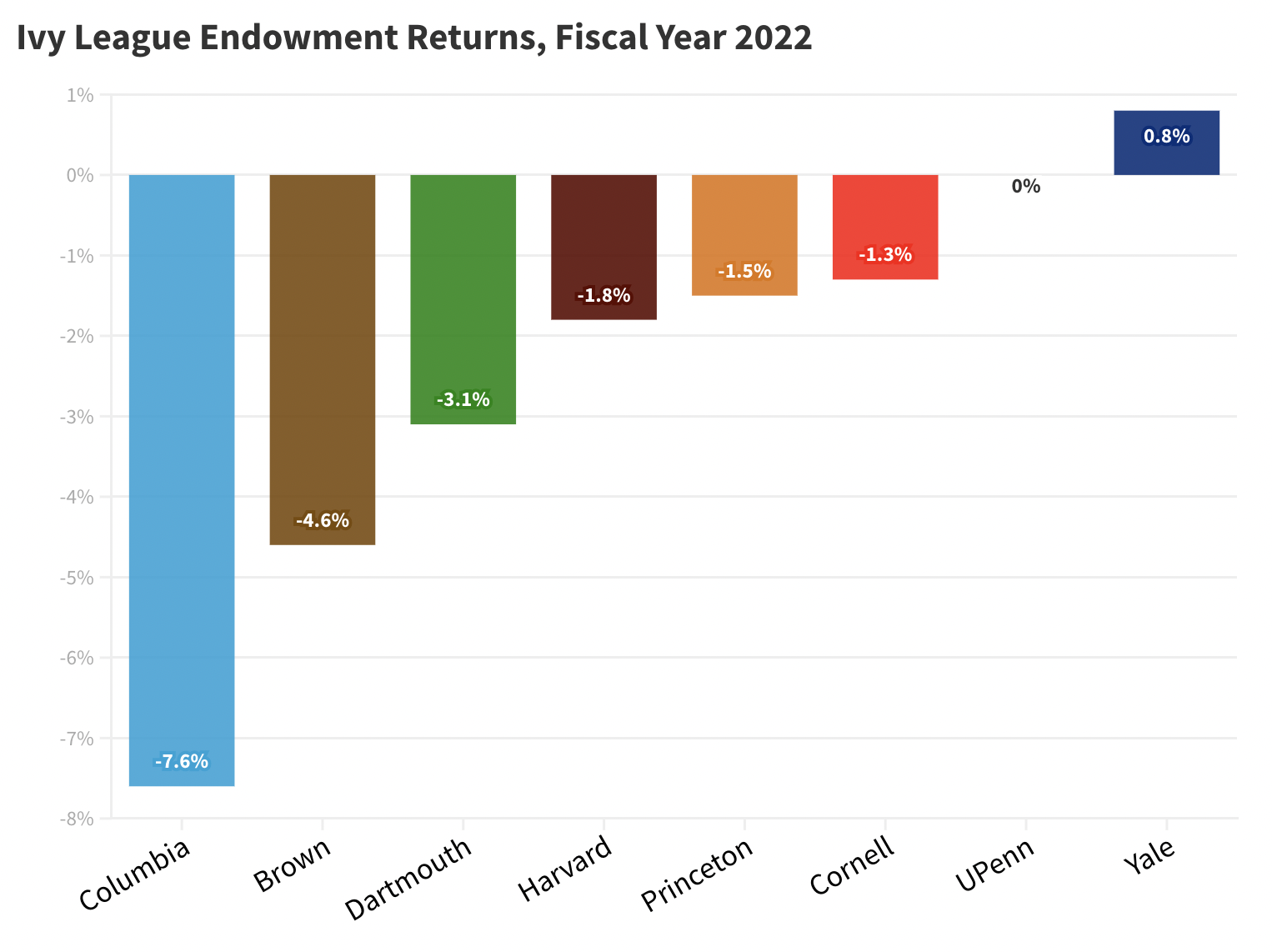

The University’s 0.8 percent return on its investment holdings was the only positive result reported by elite universities for the last fiscal year. Experts differ in their interpretations of the results.

Evan Gorelick, Production & Design Editor

Yale is the only school in the Ivy League that reported a positive return on its endowment holdings in the last fiscal year.

The University’s 0.8 percent endowment return for 2022 was its lowest return since 2009 and paled in comparison to its historic 40.2 percent return for 2021. But in a year marked by financial volatility and declining markets, nearly all the University’s peers reported losses. On Friday morning, Princeton became the last Ivy League institution to report its endowment returns — making Yale’s positive results unique among the eight universities.

Experts, however, are divided on how to interpret these results.

The 10 financial experts who spoke to the News fell into two camps: some lauded Yale’s relatively higher return as a mark of outperformance, while others were skeptical that observed differences in returns reflect true performance gaps.

“Peer performance is the best way to put the endowment return into context,” School of Management professor Andrew Metrick told the News. “Don’t let the small absolute number fool you. In some ways, the 0.8 percent this year is more impressive than the 40.2 percent that preceded it.”

Brown University posted a 4.6 percent loss, Columbia University a 7.6 percent loss, Cornell University a 1.3 percent loss, Dartmouth College a 3.1 percent loss, Harvard University a 1.8 percent loss and Princeton University a 1.5 percent loss. The University of Pennsylvania broke even with a 0.0 percent return.

Yale also outperformed non-Ivy League peer institutions like Duke University, the Massachusetts Institute of Technology and Stanford University, which have reported 1.5 percent, 5.3 percent and 4.2 percent losses, respectively.

According to Cambridge Associates, the mean college endowment return for 2022 so far is negative six percent.

“Yale has once again produced investment returns that can only be rated as excellent in the context of the general market volatility and malaise during fiscal year 2022,” Harvard Business School professor Luis Viceira told the News, “which continues to today, and in relation to its peers.”

Several experts — including Viceira and Metrick — attributed Yale’s success to David Swensen’s lasting legacy in the Investments Office.

Swensen, Yale’s long-time chief investment officer and the maven behind modern institutional asset management, managed the University’s endowment under “The Yale Model,” an investing framework he developed alongside then-senior endowment director Dean Takahashi.

Swensen passed away in 2021, but the Yale Model has stayed in place as the University’s primary investing scheme and has become the industry standard over the last three decades. Large university endowments — like Yale’s and those of its peers in the Ivy League — have used the model for decades.

The Yale Model prescribes broad diversification of assets, allocating less to traditional U.S. equities and bonds while investing more in alternative investments like private equity, venture capital, hedge funds and real estate.

As of 2019, alternative assets comprised about 60 percent of Yale’s portfolio.

Rutgers Business School Professor John Longo gave one possible explanation for Yale’s relative success this year: although Yale and its peer institutions invest heavily in alternative assets, not all alternative assets are equal.

“Yale was the first major endowment to fully embrace alternative investing, so they likely have strong relationships with the preeminent alternative managers, which are often capacity constrained, perhaps providing Yale with a durable, long-term advantage,” Longo wote in an email to the News.

School of Management professor Heather Tookes agreed, noting that Yale’s relative outperformance is “not surprising given its strong reputation for manager selection and its experienced team.”

Other experts interviewed by the News, however, were hesitant to give credence to reported returns.

Because alternative assets are illiquid — and thus do not have regular market prices — their value must be estimated when it comes time to report returns every year. Such estimation is notorious for providing investors “wiggle room” to artificially inflate reported returns during market downturns.

“A major issue is the requirement that each endowment ‘mark to market’ the fair value of its investments in private equity, hedge funds, and other ‘alternative’ asset classes that do not trade regularly and do not have reliable benchmarks,” NYU Stern professor David Yermack wrote in an email to the News. “There is a lot of guesswork involved, especially in a year like 2022 in which the trading activity in these asset classes dropped significantly.”

Since price uncertainty of illiquid assets may artificially inflate Yale’s reported returns, some experts interviewed by the News were reluctant to conclude that Yale’s slight edge indicates a true difference in performance.

School of Management professor Matthew Spiegel suggested that differences in reported returns might reflect “nothing more than stale market values for the underlying holdings.”

When the economy is slow and there are fewer market transactions than usual, investors often lack new data to estimate alternative asset values, which can cause estimations to reflect outdated, or “stale,” market values.

“Given the difficulty of valuing illiquid assets, some of these differences may not really be significant,” School of Management professor William English wrote in an email to the News. “Yale came out okay in a very tough investment environment, but so did a number of other schools.”

Yale’s vulnerability to price uncertainty is not unique, though. The University’s peer institutions are similarly vulnerable to faulty reporting because they, too, invest heavily in illiquid assets.

Therefore, Spiegel told the News, to accurately assess relative performance, he would need to know relative illiquid asset holdings across universities.

“To what degree is Yale invested in illiquid assets relative to the other [universities] — more, less, about the same?” Spiegel wrote in an email to the News. “If it is more, then perhaps the relative performance is just due to the fraction of stale prices in the valuation reported by each university. If it is about the same or less, then I would say you have to be impressed with how well Yale did relative to the competition, at least given what we know today.”

Yermack is inclined to believe the former. Because Yale is notorious for “over-weighting” illiquid assets, Yermack said, it is probably vulnerable to more price uncertainty “than any other university.”

Viceira disagreed, arguing that differences in illiquid asset valuation are probably too insignificant to undermine Yale’s supposed outperformance. He said it would be “hard to believe that any adjustment [for inaccuracy] would alter the conclusion that [Yale’s] performance has been excellent in absolute and relative terms.”

School of Management professor Geert Rouwernhorst noted that, regardless of what we conclude about relative performance among universities, Yale and its peer institutions did very well relative to the market.

The 2021-2022 fiscal year was a “very difficult time for investors,” Rouwenhorst said. The S&P 500 fell more than 10 percent during the period, and the MSCI world index fell by more than 15 percent.

“It would not be realistic to expect the Yale endowment to return 40 percent again this past year, given the poor performance of almost all the major asset classes during that time period,” School of Management professor James Choi told the News. “The low returns of Yale and all of its peers reflects that falling tide that is lowering all boats.”

During Swensen’s 35-year tenure, Yale’s investments returned 13.7 percent per year on average.