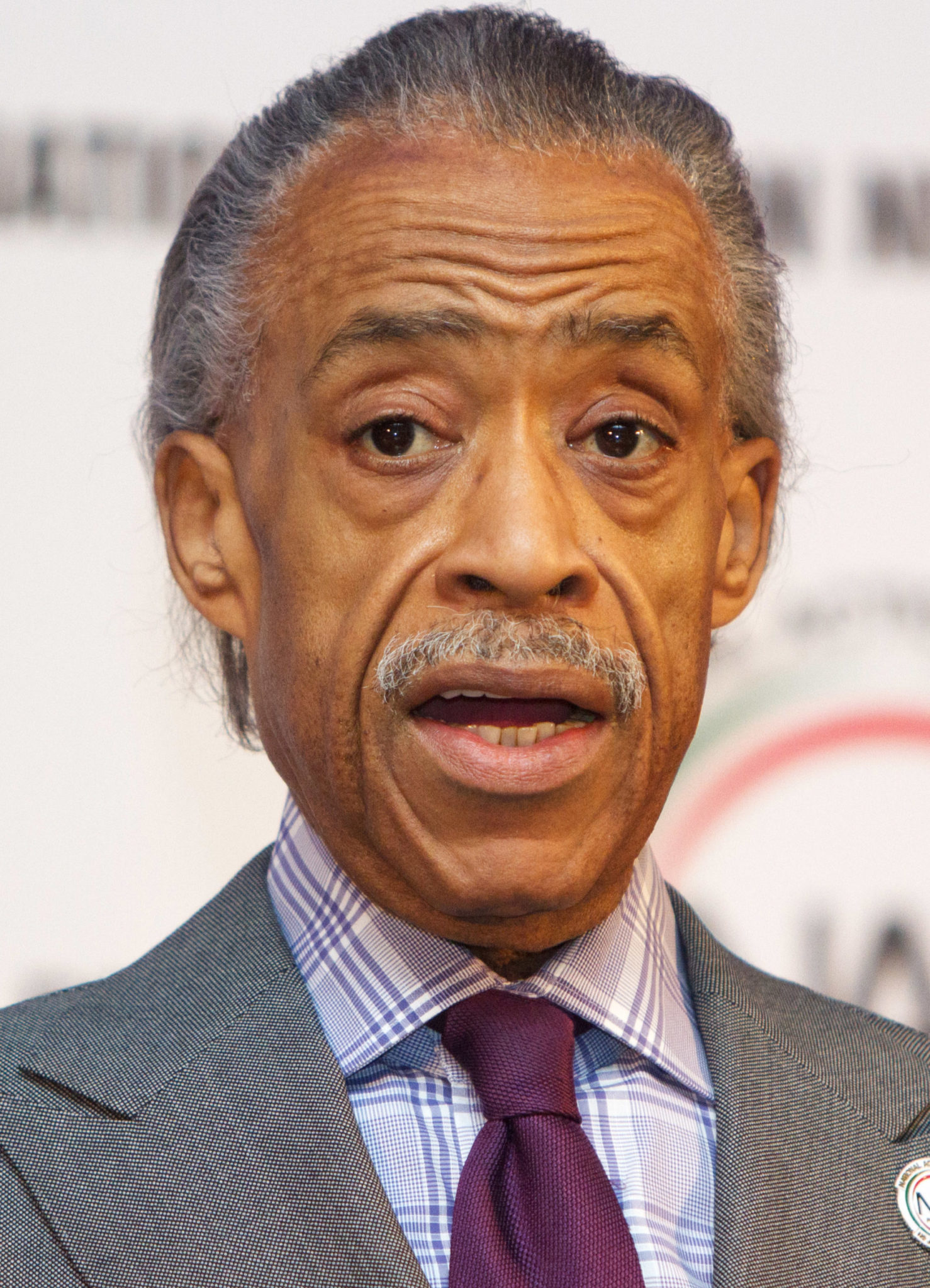

Wikimedia Commons

Noting a lack of women and people of color in the field of asset management, civil rights activist Rev. Al Sharpton called on Yale to compile a report on the diversity of its endowment managers.

Sharpton wrote to University President Peter Salovey and Chief Investment Officer David Swensen on March 19 requesting that Yale document the number of African American asset managers on both its internal and external teams. The request, Sharpton wrote, is based on multiple studies that cite underrepresentation of women and people of color in the asset management industry, despite data citing these groups’ impressive performances in the field.

“The question is simple,” Sharpton wrote. “If you aren’t working with the best, fail to track or report with whom you are working with, how do you know that you are in fact maximizing performance?”

Yale is not the only recipient of a letter from Sharpton, who currently serves as the President of the National Action Network, a nonprofit civil rights organization the activist formed in 1991. Over the past few weeks, Sharpton has also sent similar requests to Harvard University, Princeton University, Cornell University and the University of Michigan.

When asked if and how he planned to respond to Sharpton, Salovey discussed the merits of the President’s Committee on Diversity, Inclusion and Belonging, a group formed this past February to identify diversity “goals for the University, as well as strategies, actions, and assessments for achieving these goals.”

Committee co-chair Vice President for University Life Kimberly Goff-Crews ’83 LAW ’86 told the News in a statement that the committee is continuing its work “while recognizing new circumstances,” and that “equity, inclusion and belonging are important themes in community conversations right now.”

“At Yale, we recognize that diversity is a fundamental pillar of our university and our country,” Salovey wrote to Sharpton. “Diversity is essential to Yale’s mission to educate aspiring leaders who serve and contribute to all sectors of society. We are taking steps to foster diversity within every department and section at Yale, including the investments office. We also are committed to creating an inclusive and equitable campus environment, where everyone feels a sense of belonging.”

According to the committee’s website, members have been meeting throughout the spring semester and will present a report on these recommendations at the end of the academic year.

According to Sharpton’s letter to Salovey, the NAN was “impressed” by the University of California system’s December 2019 report. That report found that the UC system’s asset managers and investment partners are more diverse than national averages for the industry. Still, the report says, UC Investments will implement a new program called “Diversified Returns” in 2020 with the goal of cultivating business ties with firms owned and run by women, African Americans and Latinx.

In his letter to Salovey, Sharpton wrote that the University of California is “to be commended” for demonstrating its commitment for fiduciary responsibility. He told the News that the global reputation of institutions like Yale as “outstanding and fair and liberal institution[s] of learning” conflicts with a lack of transparency about diversity and inclusion on their campuses.

“We are concerned as an organization, about a lot of our historic institutions, like Yale, Harvard and others in terms of being transparent about how they do their investments in their endowment,” Sharpton told the News.

Sharpton added that the NAN has already consulted with major companies such as Comcast and AT&T, as well as the City of New York, to work out goals and targets regarding diversity in the hiring process.

Still, the NAN is not alone in its efforts to promote diversity in the investment industry. The Diverse Asset Managers Initiative, founded by former Assistant Attorney General at the Department of Justice Robert Raben, partnered with Sharpton’s team to push for the kinds of reports the NAN is requesting from Yale.

Raben added that the “importance of Yale cannot be overstated,” noting both the size of Yale’s endowment and Swensen’s trailblazing management since 1985. According to Raben, Swensen’s mentorship of men who went on to other jobs in the predominantly male-dominated industry has an immense impact “in terms of the effect on the entire nation.”

According to a recent DAMI report surveying 30 major investment firms in the United States, white males hold a significant portion of senior management positions. In the introduction of that report, DAMI states that diverse-owned firms manage only about 1.1 percent of more than $71.4 trillion in assets in the U.S.

Valerie Pavilonis | valerie.pavilonis@yale.edu