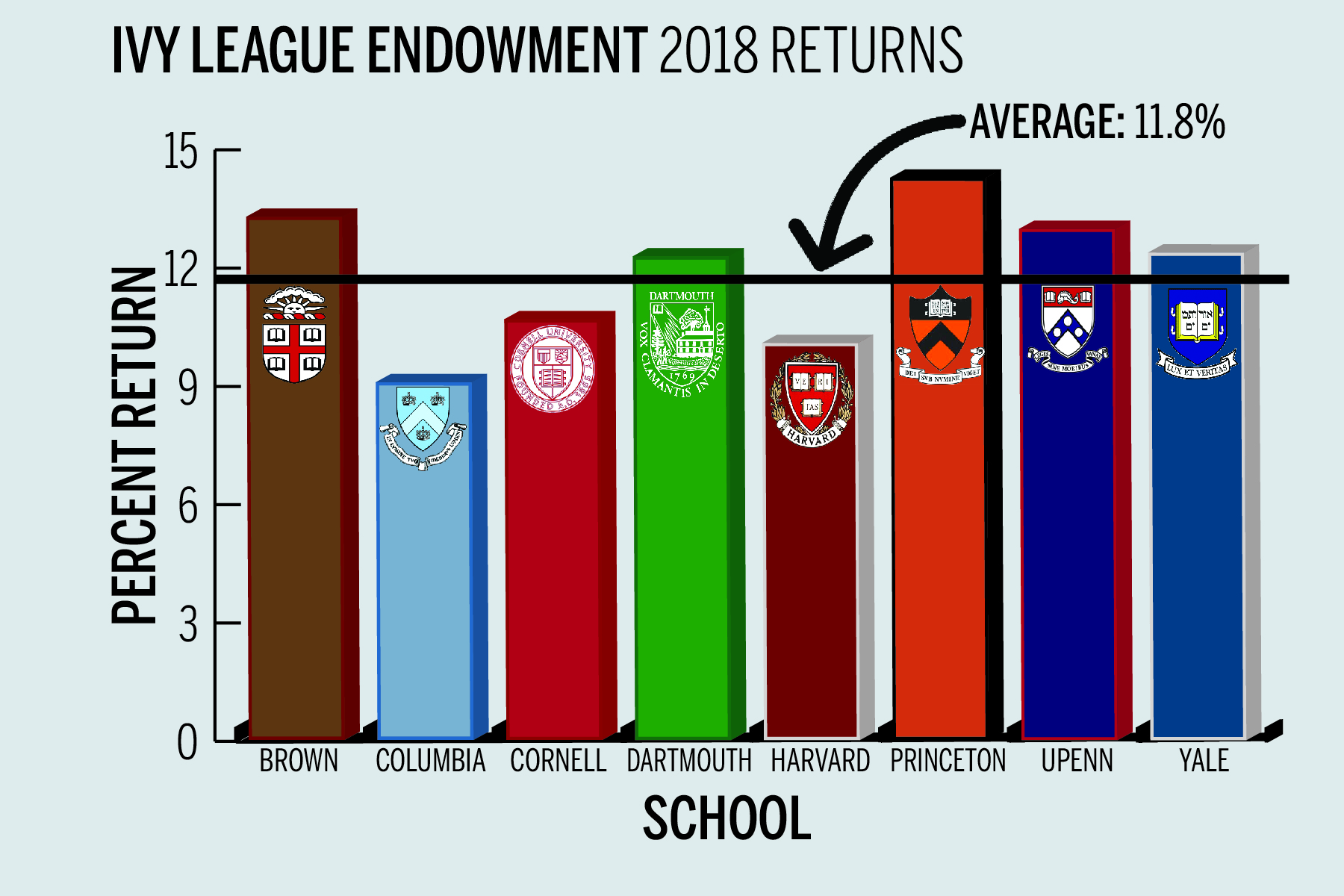

The eight Ivy League schools released their annual endowment returns in October. Yale, with a return of 12.3 percent for the fiscal year that ended on June 30 fell above the Ivy League average of 11.8 percent.

But endowment managers say that a 12-month period is not sufficient to properly assess an investment office’s relative success or failure. Though investment experts and economists interviewed by the News agreed that annual metrics could be useful, they emphasized that a long-term view is a better measurement of endowment performance.

“Taking the long view is the best way to appreciate the superb work of [Chief Investment Officer] David Swensen and his investment team on behalf of Yale,” University spokesperson Tom Conroy told the News. “Over the past 20 years, the investment return has averaged 11.8 percent annually, compared to the estimated 6.8 percent average return of college and university endowments. The return in the past year is in keeping with Yale Investments’ long-term performance, which provides support for every faculty member, student and staff member at the University.”

Yale was one of the first Ivy League schools to report its fiscal returns for 2018 on Oct. 1. This year, the University fared better than Dartmouth, Cornell, Harvard and Columbia Universities but fell slightly short of Princeton University, Brown University and the University of Pennsylvania’s endowment returns.

“The results of any one-year period tell very little about the efficacy of a long-term investment strategy,” stated a 2013 endowment report released by the Investments Office. “Performance over longer horizons demonstrates the strength of Yale’s investment program.”

The Investments Office could not be reached for comment on Monday evening.

According to economics Professor and Nobel laureate Robert Shiller, because institutions like Yale have a long-term investment horizon, investors have the advantage of viewing endowment performance through a multiyear lens.

“Investors have to confront the fact that day-to-day or year-to-year movements in speculative prices are largely unforecastable,” Shiller said. “Investors have to take chances in the short run and rely on the law of averages to win in the longer run.”

As of June 2017, Yale had allocated more than 70 percent of its investment portfolio to alternative assets including hedge funds, real estate and private equity — which require long-term investment commitments. Under Swensen’s tenure, alternative assets have proven to be lucrative for Yale.

Charles Skorina, an investment executive recruiter, said that when assessing university endowments, he and his partner analyze the five-year and 10-year annualized returns.

“It takes about 10 years [for an investor] to completely put [their] own stamp on a major endowment portfolio, because investing in private equity and real estate are legal commitments to long-term investment,” Skorina told the News.

Skorina noted that yearly returns are also helpful as “a series of data points.” According to Skorina, these data points can show the accuracy of an investment office’s assumptions.

As of June 2018, the University’s endowment is valued at a record $29.4 billion — a $2.2 billion uptick from last year’s previous record of $27.2 billion.

Lorenzo Arvanitis | lorenzo.arvanitis@yale.edu