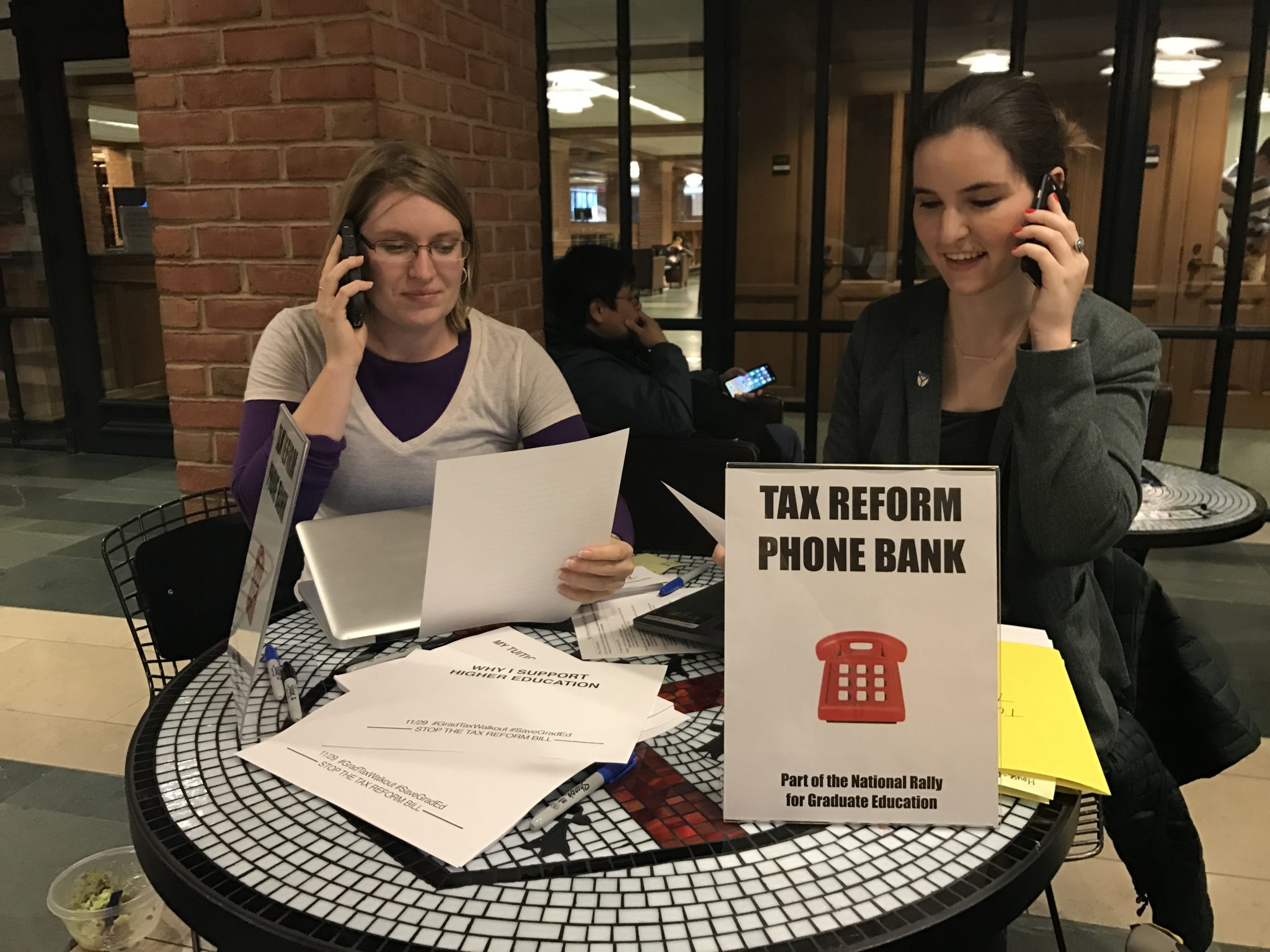

Graduate students, with scripts in hand, called their congressional representatives Wednesday to urge them to vote against the U.S. House of Representatives tax bill, which would effectively triple the amount Yale graduate students pay in taxes.

The phone banks, which graduate student leaders set up in four locations across campus, including Bass Cafe and the Yale School of Medicine, are part of a national campaign against the bill, which passed the House last Thursday. Student organizers said it is important to build on-campus opposition to the bill across the country.

“There’s not Republican graduate school or Democratic graduate school. We are all just here in graduate schools, so we’ll all be affected exactly the same,” said Katie Oltman GRD ’19, a phone bank organizer. “It doesn’t matter who you voted for, even if you didn’t vote at all. If somebody takes away your ability to have an education, then you don’t have an education.”

Sarah Smaga GRD ’19, another student organizer, said about 50 graduate students participated in Wednesday’s phone banking effort.

Yale was quick to respond to graduate students’ fears about what the bill could mean for their futures. Dean of the Graduate School of Arts and Sciences Lynn Cooley sent an email to graduate students a day after the plan went public affirming the University’s opposition to the proposal and actively gauging the specific effects on Yale. She organized a town hall on Nov. 13, in which graduate students aired their concerns before a lawyer from the Office of General Counsel.

The repeal of a tax break on tuition reduction, a component of the House tax bill that would cost graduate students at Yale an additional $5,500 annually, has sparked outrage among graduate students. The clause repealing the tax break has not yet appeared in the Senate proposal, but Senate Republicans are still debating key provisions of the plan.

Gregory Huber, a political science professor at Yale, told the News that the tuition reduction tax is less popular in the Senate than in the House and that it is unlikely to show up in the upper chamber’s final proposal.

Oltman said graduate students and their allies should continue to rally against the provisions of the bill targeting graduate students until Congress clarifies the “nebulous” terms of the bill.

“Things are moving really quickly,” Oltman said. “It’s important to continue to reinforce the message that it’s crucial that this doesn’t go into the bill.”

She added that she has been urging her family and friends back home in Nebraska to call their congressional representatives on her behalf for the past two weeks.

Ted Hamilton GRD ’22, who participated in the phone bank, said hitting their concerns home with congressional members, even with those already opposed to the proposal, would be helpful.

“There is certainly wiggle room for negotiation around provisions,” Hamilton said. “They are constantly looking for different things to cut or add back in. And there is still a chance that it could fail, and they would start again. ”

Smaga, another student organizer, who helped put together scripts for the phone banks, said Yale students should call people outside of Connecticut — a reliably blue state. The message for each script differed based on the position and party of the congressperson, she added.

“For Democrats it was ‘thank you for protecting education, please be mindful of this going forward, make sure the provision stay out of any final bill,’” she said. “For House Republicans, it was like ‘I oppose this thing that you passed, please don’t include it the next time you see the bill.’ While for Senate Republicans it was ‘thank you for protecting tuition credit and … student loan interest deductions,’” Smaga said.

The Republican tax plan passed the House on Nov. 16 by a 227–205 vote.

Jingyi Cui | jingyi.cui@yale.edu