Yale’s graduate students could pay nearly three times more in taxes annually — or about $10,000 — under the tax plan proposed last Tuesday by top Republicans in the U.S. House of Representatives.

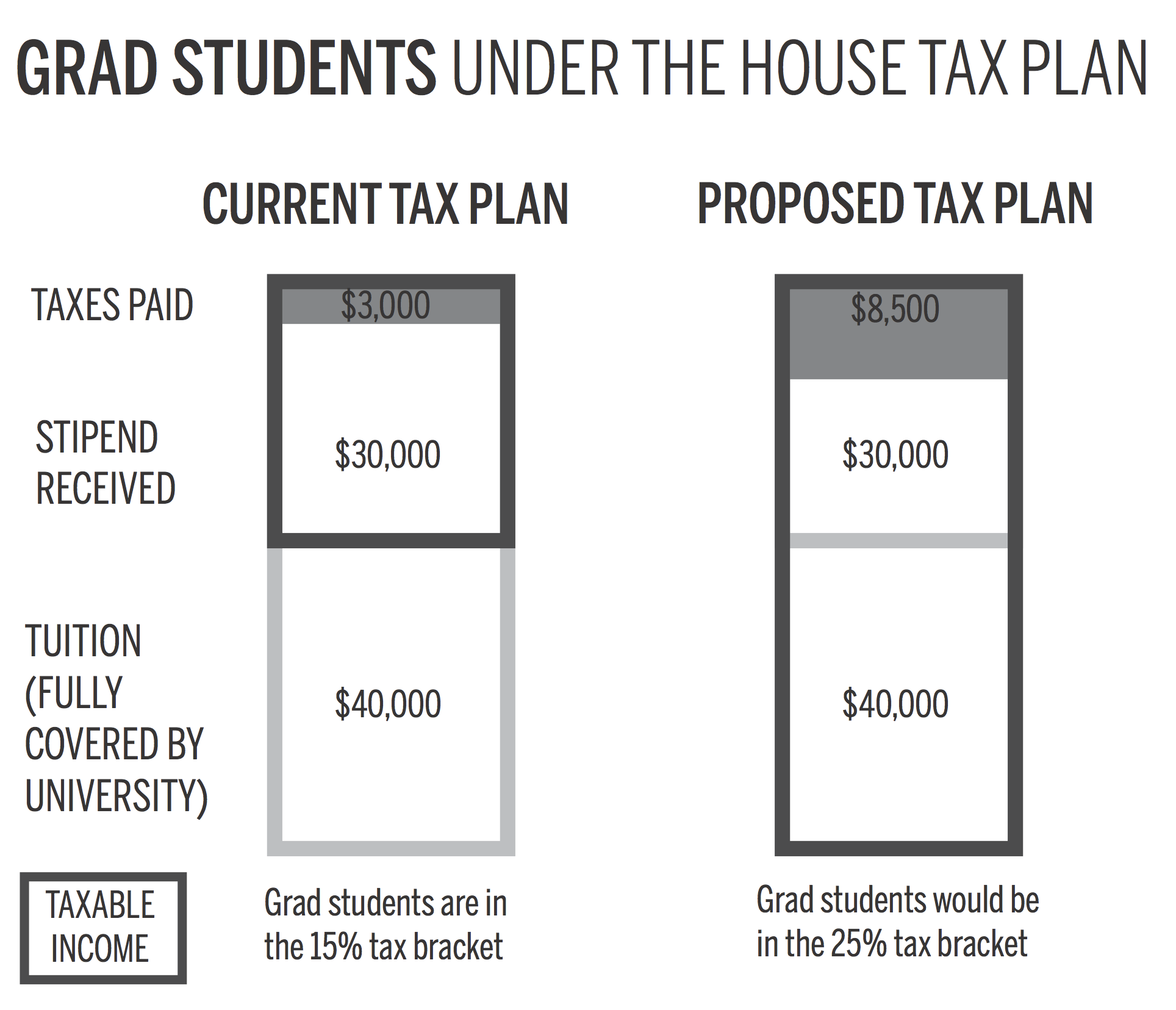

The tax plan strikes down section 117(d) of the U.S. Tax Reform Act of 2014, which makes reductions in students’ tuitions nontaxable. At Yale, graduate students currently receive a minimum annual stipend of about $30,000 and an additional tuition reduction of about $40,000. While they pay taxes on the stipend, the tuition reduction — which covers tuition entirely — is tax-free. Graduate students interviewed said the repeal would impose an “impossible” financial burden and make it harder for U.S. graduate schools to attract top talent.

“The student community is very worried about this,” Aritra Ghosh GRD ’23 said. “This is [about] whether you can live off your stipend or not.”

If the plan goes through, it will cost graduate students at Yale about $5,500 more each year to pursue their graduate degrees. Under the current system, graduate students are in the 15-percent bracket and pay just over $3,000 annually in taxes. By making the $40,000 tuition reduction taxable, the proposed tax plan would push students into to a 25-percent tax bracket, meaning students would have to pay roughly $8,500 to the government.

Dean of the Graduate School of Arts and Sciences Lynn Cooley said in an email to the graduate student community that the tax reform legislation “could increase” the cost of earning a degree.

She acknowledged that the repeal of 117(d) would affect some institutions that rely on the provision to exempt graduate students from income tax over tuition reduction. Cooley did not make it clear, however, whether Yale is among these universities. She added that the University is still studying how the repeal would affect graduate students at Yale and examining ways to preserve the tax break.

“Tax incentives, such as the student loan interest deduction, are critical to helping make higher education more affordable,” Cooley wrote in the email. “These provisions have my unwavering support and Yale is strongly opposed to these draft amendments.”

Ghosh said the University’s response is “vague” but “adequate” for the time being, recognizing that it will take the University time to sift through the tax plan and draft legal opinions.

Michael Warrener GRD ’22 said the plan could change the trajectory of his career if it passes.

“[The increased cost] either means that I’m going to have to take out loans, which is not something I’m really prepared to do, or I have to leave, and I don’t really want to think about leaving because this is what I’ve always wanted to do,” Warrener explained. “I’m not going to drive myself into debt that I can’t pay off.”

Ryan Petersburg GRD ’21 said that, although Yale does not pay the income tax itself, the University would be affected in the long term, explaining that the new system would discourage students from pursuing doctoral degrees, thus forcing Yale to change its payment structure to attract top talent.

Some universities would avoid the negative consequences of the plan. In an email to its graduate students on Monday, Cornell affirmed that the proposed repeal would not affect graduate students because the university counts tuition reduction as “qualified scholarships,” which are outlined in parts 117(a), (b) and (c) of the 2014 tax bill, sections untouched by the new plan.

“Cornell University does not rely on 117(d) for favorable tuition-related tax treatment of funded graduate students — who are considered students, not employees — at Cornell,” the email states. “While the stipend for graduate students may be taxable under the current tax code, the tuition scholarship is not, and would not be, affected by repeal of 117(d).”

But higher education in the U.S. would be the ultimate victim of the new tax plan, graduate students interviewed said.

“If we want to be world leaders, then we need to be able to train world leaders, to train people to compete on the international stage in all sorts of fields,” Warrener said. “This tax law clearly says, ‘we don’t care about that.’ That’s what it says to me at least.”

The Senate has not yet released its tax plan, but Cooley is not optimistic that the Senate’s plan will be any better for students in graduate programs, saying it will likely include a revision similar to the House’s plan.

The Senate is expected to release its plan on Thursday.

Jingyi Cui | jingyi.cui@yale.edu