Connecticut posted a net job loss in September for the third month in a row, according to new data released by the Connecticut Department of Labor.

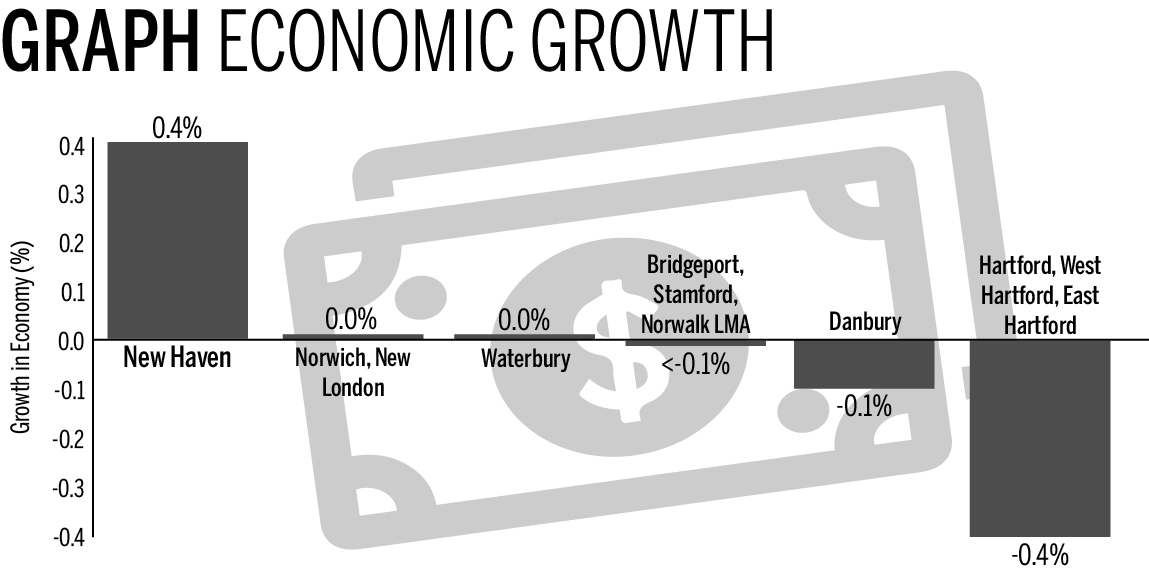

The state lost a total of 2,000 jobs in September, an improvement from last month’s 4,200-job decline. Out of Connecticut’s six labor market areas — regions demarcated for the purposes of tracking economic data — the New Haven area was the only one that saw job growth. Three market areas reported losses, while the other two were unchanged.

Department of Labor Research Director Andy Condon said he typically does not worry too much about a single month’s numbers, adding that the labor data can be “very volatile” because of the small sample size used to calculate the statistics. Still, he acknowledged, “three straight months of declining employment are not good.”

Condon said he is not sure why Connecticut has been losing jobs or whether the losses will continue in the months ahead. He mentioned that it is possible that industries had been delaying hiring due to financial uncertainty stemming from the state’s lack of a budget until last Thursday, when both chambers of the Connecticut General Assembly passed a veto-proof budget.

Some industries have suffered more than others: The state saw a total loss of 1,500 construction jobs last month, which Condon speculated could have resulted from an early start to this year’s construction season due to the mild winter. Manufacturing and financial activities were two industries that saw growth in job numbers.

The New Haven market area gained 1,200 jobs in September, making it the leader in state job growth in both numeric and percentage terms. Donald Klepper-Smith, chief economist and director of research for DataCore Partners — a local consultancy — said that New Haven’s job growth was due to the convergence of many different factors, including the “stabilizing” effects of healthcare and education.

“New Haven, I think, has done better because it has economic engines that have done better during both upturns and downturns,” he said, noting that New Haven has better “fiscal discipline” than surrounding areas.

Yet New Haven Economic Development Administrator Matthew Nemerson SOM ’81 urged caution when comparing New Haven with the rest of the state and suggested that economic data is best viewed within the broader context of the state.

“Economies aren’t 18 square miles [and] 130,000 people,” he said.

Nemerson added that university cities like New Haven are advantaged as the national economy places more and more value on knowledge creation. He listed the fields of biotechnology, software and consulting as examples. As a major university city in Connecticut, he said, New Haven has the potential to attract many of those jobs.

Mayoral spokesman Laurence Grotheer said that New Haven has been working to attract technology companies, particularly those that would supplement the “flourishing” biotechnology industry. To demonstrate, Grotheer pointed to the incubator space currently being built for new technology companies at District New Haven, a multitenant office building located at 470 James St.

City Hall has been taking more steps to attract businesses and increase employment opportunities in the region, Grotheer said.

Last week, New Haven submitted a joint proposal with Bridgeport to host Amazon’s second company headquarters. The two cities have also formed a partnership to attract and build an MGM casino, which would include a job training center in New Haven, Grotheer said.

The goal of these partnerships is to “accelerate the move toward a regional approach to economic development,” he added.

Just as Condon referenced the delayed state budget as a deterrent to economic growth, Grotheer said that New Haven had been affected by “prolonged uncertainty” due to its reliance on state aid to bridge the gap created by the state’s laws governing municipal taxes.

The state limits cities to just one locally assessed tax: a property tax on real estate, motor vehicles and personal property, he said. Since nonprofit colleges, universities, hospitals and government buildings are tax-exempt, Grotheer said, more than half of New Haven’s “grand list” becomes tax exempt.

“City officials remain hopeful, certainly, that all of the advantages centered in New Haven will continue to attract employers, entrepreneurs and a talented workforce to make those companies flourish,” he said.

Connecticut has recovered 76 percent of the jobs lost in the Great Recession and will need an additional 28,400 jobs to reach employment expansion.

Talia Soglin | talia.soglin@yale.edu