This story has been updated to reflect the version that ran on Sept. 27.

Yale’s endowment outperformed its peers in the last fiscal year, despite dropping in value for the first time in five years.

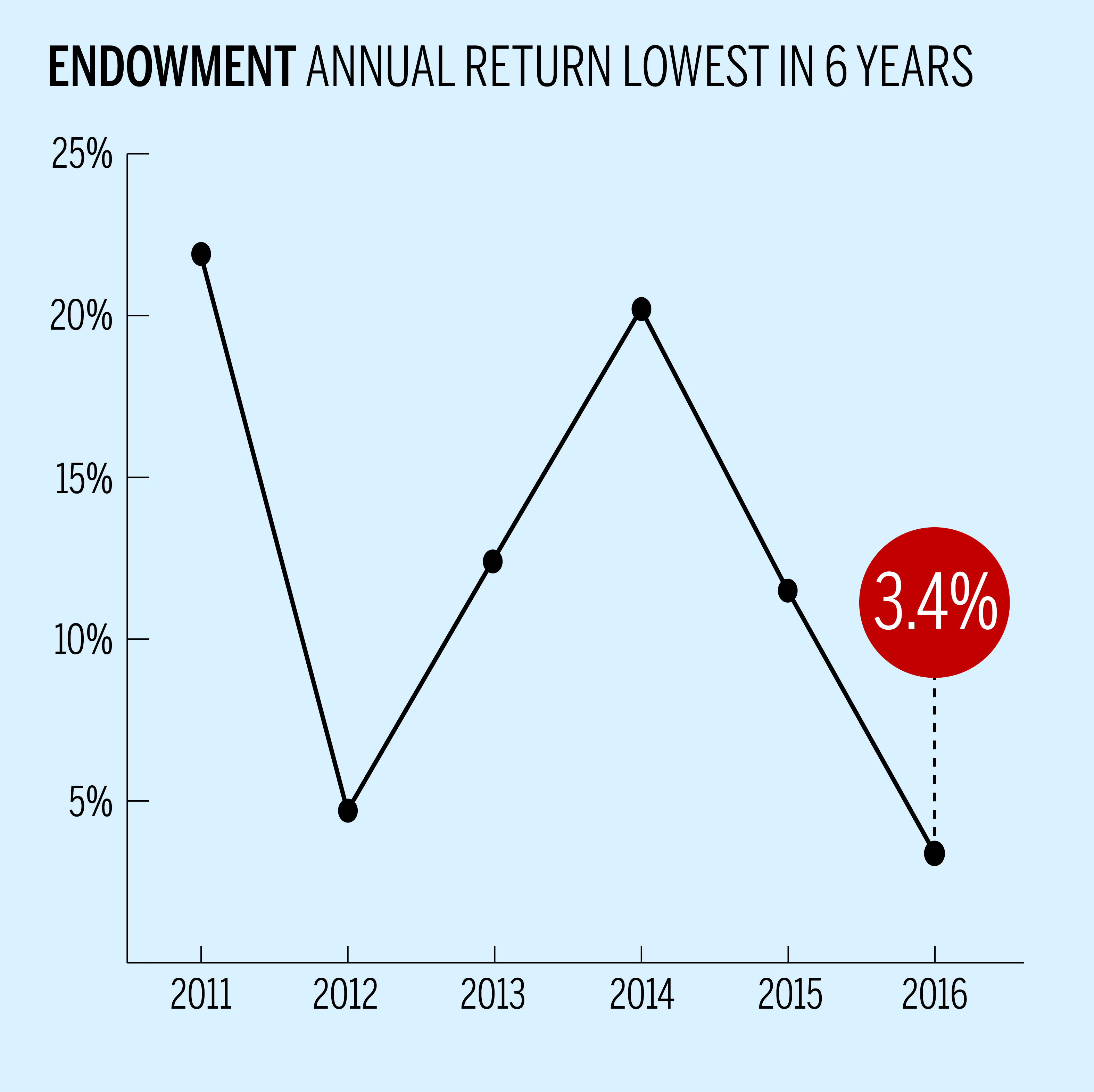

The endowment fell from $25.6 billion to $25.4 billion in fiscal 2016, the Investments Office announced Friday, ending a period of robust financial growth for Yale that has been ongoing since the 2008 financial collapse. But given negative returns for university endowments nationwide, Yale’s 3.4 percent return — a five-year low — is cause for the Investments Office to celebrate.

Yale’s return of 3.4 percent is robust compared to an average loss of 2.7 percent among colleges and universities over the past year, according to Cambridge Associates, an national endowment management company. Harvard University, whose endowment returns have lagged behind Yale’s for the past six years, reported Thursday that its endowment dropped in value by 2 percent last year.

The drop in endowment returns arrives in conjunction with an increase in administrative spending: This fall, the University finished five major campus building projects, including a new chemistry laboratory and the renovation of the Center for British Art. Yale administrators also announced a host of new spending initiatives like a $50 million campaign to recruit more diverse faculty members, increases to the undergraduate financial aid budget and additional funding for campus cultural centers.

After two especially strong years — the endowment returned 11.5 percent and 20 percent in 2015 and 2014, respectively — Yale is leaning more heavily on endowment spending. The University projects to spend around $1.2 billion of the endowment on the budget, around 34 percent of Yale’s total revenue for the year.

The endowment has hit new highs in each of the last five years, growth which Yale has credited to Chief Investment Officer David Swensen. But the slowdown in growth and fall in endowment value is out of line with this successful trend.

Swensen could not be reached for comment over the weekend.

Many U.S. college and university endowments are struggling to grow in a market with low interest rates and volatile world markets.

The markets may partly be to blame for Yale’s poor performance. A report from Wilshire Trust Universe Comparison Service found that endowments have been performing poorly since 2015.

In the long term, Yale’s returns are still better than its peers, with 10-year returns of 8.1 percent on average. In Investments Office reports, Yale has tended to stressed the endowment performance over many years than a single fiscal year. While Harvard’s endowment management team has seen four changes in leadership in a decade amid stagnant growth, endowment experts have seen David Swensen’s decades long tenure as a stabilizing force at Yale.

Yale’s investment strategy, laid out in asset allocation targets, remains largely the same going into fiscal 2017 , with slightly more emphasis on certain assets like venture capital, which has earned Yale considerable returns in past years.