Earlier this week, Yale disclosed information about how it spends and manages its $25.6 billion endowment in response to questions from members of the United States Congress about how wealthy institutions spend their endowments.

On April 1, Yale submitted the endowment disclosure, which included a cover letter penned by University President Peter Salovey, to three leaders of both the Senate Committee on Finance and the House Committee on Ways and Means, marking the second time in the past decade Yale has provided endowment-related information to Congress. The report answers to an investigation conducted by the two committees, which requested in February that 56 colleges and universities with endowments over $1 billion provide information on their endowment management.

While endowment experts interviewed said these Congressional concerns — some of which question whether universities like Yale spend their endowments with the interests of students in mind — are misguided, Salovey’s letter sought to reassure legislators that Yale’s endowment is essential to furthering its educational mission. The letter also attempted to show that Yale spends and saves money in efficient and effective ways, despite concerns from Congress. The deadline for colleges and universities to respond was April 1, and many of Yale’s peer institutions submitted similar letters.

“The congressional questionnaire provided us with a welcome opportunity to explain in detail to members of Congress how the endowment works and its fundamental role in allowing us to maintain Yale as a world-class university that is accessible to students from families across the income spectrum,” Salovey told the News.

Salovey said he sought to emphasize three points in his cover letter: that the endowment is the source of support for Yale’s substantial financial aid programs, that endowment funds cannot be spent however and whenever University leaders would like and that endowment spending is guided by an effort to balance current interests with those of future generations.

Vice President for Communications Eileen O’Connor said that in Salovey’s letter, the University tried to emphasize that even during years when the endowment performs well, Yale has to be careful not to overspend.

The congressional inquiry was particularly concerned with Yale’s spending rate — the percentage of the endowment put toward the operating budget each year. Over the past 10 years Yale’s spending rate has averaged 5 percent. Salovey wrote that this constant spending rate provides a stable flow of resources to the operating budget.

“For us, this was really explaining the purpose of the endowment,” O’Connor said. “We were trying to explain how we aim to strike the right balance between careful spending to support programs and ensuring that we will be able to provide that support for future generations. That is a key part of this.”

Salovey’s letter answers a total of 13 questions about the market value of the endowment, the University’s spending rate over the past 10 years and the percentage of the endowment devoted to financial aid.

Richard Jacob, associate vice president for federal and state relations, said he believes the questions stem from lawmakers’ desire to learn more about university endowments generally before potentially engaging in comprehensive tax reform. He said a number of University employees worked on the letter, though he declined to specifically name them.

“Frankly there is a lot of overlap with the questions proposed in 2008 by the Senate finance committee,” he said. “We view it as an information request and took it in stride and will keep an eye on that issue and continue to engage with those committees as we go into 2017 and potential changes to tax policy in general.”

Yale’s letter came amid a statewide discussion, prompted by state legislators in Hartford last week, on whether Connecticut should implement a tax on endowments larger than $10 billion. Yale’s is the only endowment of that size in the state. In January, Republican Rep. Tom Reed drafted a bill that would require wealthy schools to spend a flat rate of 25 percent of their endowment returns, with penalties for institutions that did not comply, but the bill did not pass.

In January, University Spokesman Tom Conroy called Reed’s proposed bill “highly problematic,” adding that any legislation concerning Yale’s endowment has the potential to limit the University’s ability to pursue its educational mission.

“College endowments exist to support financial aid for students, support research and advance these institutions’ charitable missions,” Conroy told the News. “Yale could not do all it does now on campus and in the community if the endowment, which funds a third of the University budget, were diminished by legislation.”

William Jarvis ’77, executive director of the Commonfund Institute, an institutional investment firm, said it is not unprecedented for U.S. politicians to be skeptical of large private endowments. The dislike of private pools of money outside the democratic process dates back to the 19th century, he said, adding that today, university endowments are often thrust into the public spotlight as the federal government looks to manage these endowments.

“Right now universities are written about more, are watched more. They’re regarded as financially sophisticated and successful investors,” Jarvis said. “It’s a battle between the social service sector and a secular state.”

But these congressional inquiries have not always been futile, said Jarvis. Starting in the 1960s, several decades of congressional pressure on universities to increase financial aid spending has changed how universities like Yale and Princeton spent their endowments, he said.

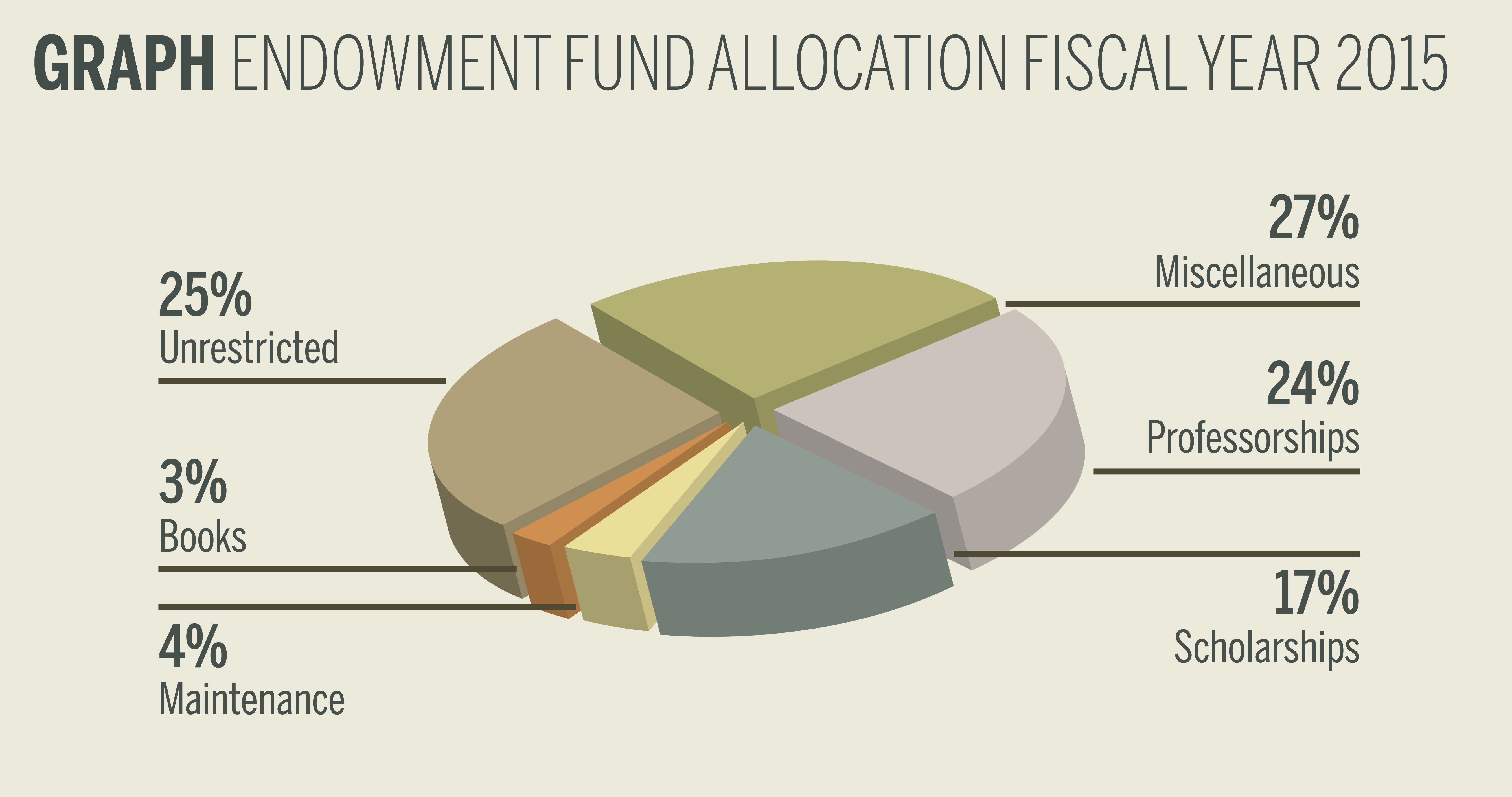

Jarvis said legislation often overlooks the fact that university endowments are restricted, meaning they can only be spent on certain things, like financial aid.

Yale’s endowment consistently outperforms its peers under the guidance of Chief Investments Officer David Swensen. Congress asked Yale how much it spends on endowment management in the form of both salaries and benefits for employees in the Investments Office and in fees charged by external endowment managers. In fiscal year 2015, Yale employed 49 people to manage the endowment, spending a total of 1.36 percent of the endowment’s market value of $25.54 billion in the same year on endowment management. This means Yale spent roughly $347 million on endowment management last year.