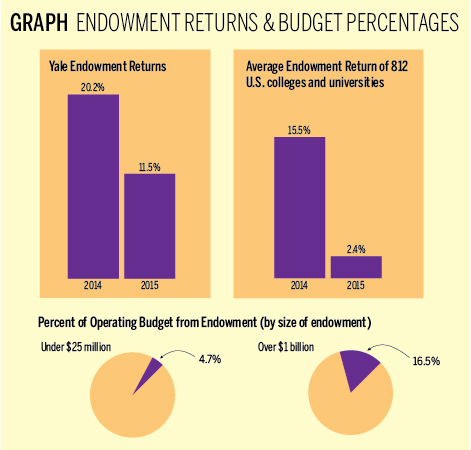

While endowment returns at hundreds of U.S. colleges and universities declined last fiscal year, spending rates at those schools increased. At Yale, however, both endowment returns and spending remained steady.

A Jan. 27 study of endowments at 812 schools conducted by two institutional investment firms showed that the average school made 2.4 percent on its endowment in the 2015 fiscal year, down from 15.5 percent returns the previous year. Yet despite these lower endowment returns, the report — co-authored by The Commonfund Institute and the National Association of College and University Business Officers — found that many schools increased the amount they spent from their endowments to support initiatives like financial aid and faculty research. Increased spending was even more common at schools with endowments of over $1 billion, such as Yale. Ninety-four of the 812 schools studied had endowments over $1 billion.

“The spending increases were quite substantial,” said Ken Redd, the NACUBO director of research and policy analysis. Much of the increased endowment spending went to support students, funding scholarships and other student programs, he added. The study reported that the median spending increase was 8.8 percent.

Larger endowments performed better last year, the study also showed. Redd said that on average, the largest endowments above $1 billion had returns of 4.3 percent, compared with 2.3 percent returns for the 96 schools studied with endowments of less than $25 million. Last year the Yale endowment returned 11.5 percent, bringing the total endowment to $25.6 billion.

Size alone did not determine an endowment’s performance, according to endowment experts interviewed. Asset classes, the kinds of industries an endowment invests in, play a significant role in determining the fate of an endowment, Redd said. Yale has long been lauded for successful investment strategies, and the University’s endowment regularly outperforms endowments at peer schools.

Larger endowments were more likely to have money invested in venture capital, while only 1 percent of smaller schools had venture capital stock, according to Redd. Venture capital in endowment portfolios gained a startling 15.1 percent, making it the best-performing asset class, while commodities and natural resources saw a negative 17.7 percent return. Different asset allocations likely caused the higher returns in larger endowments, Redd added. Yale currently allocates 14 percent of the endowment to venture capital.

According to William Jarvis ’77, managing director of the Commonfund Institute, larger endowments may also perform better because they can more easily avoid risk.

“If you have more eggs in more baskets, you’re less likely to be negatively affected by a bad year,” Jarvis said, adding that endowment management is not just about picking good stocks, but also about avoiding losses. Yale’s Chief Investment Officer David Swensen has been a master of this technique, Jarvis said.

A larger endowment is not only able to avoid potential losses more easily but can pay for an endowment management team, Jarvis said. Generally, schools with endowments smaller than $500 million do not have any in-house staff, while schools like Yale with endowments in the billions can employ nine or more staff members devoted to managing the endowment and making financial decisions, which improves overall endowment performance, Jarvis said. The Yale Investments Office employs over two dozen people.

The real problem shown by the survey results, Jarvis said, is the decline in the average 10-year endowment returns, which fell from 7.1 to 6.3 percent last fiscal year among the 812 schools.

Without strong 10-year returns, schools may have trouble coaxing donors to give money to the endowment, since low returns demonstrate that a school is not generating wealth with the donor’s money over a long period of time.

“If [donors] lack confidence in the ability of the institution, they won’t make an endowed gift,” Jarvis said. Most donors today are young people with self-made wealth, who are financially savvy and will be critical of an institution’s money management, Jarvis added.

But a year with high returns might not always be cause for celebration, Jarvis said, and “uncritical people” will often misinterpret a slump or spike in Yale’s returns. The goal of a school like Yale is to see steady returns over a long period of time, not huge ups and downs, he said.

“[Schools like Yale] have very little tolerance for volatility,” Jarvis said, noting that Swensen is “trying for reasonably high returns.” Swensen declined to be interviewed for this article.

Yale’s endowment spending policy — which determines what share of endowment earnings fund University operations — seeks to keep a stable flow of income moving toward the operating budget, said Yale’s Chief Financial Officer and Vice President for Finance Stephen Murphy ’87. Yale’s financial administrators set the spending budget in advance by predicting the future value of the endowment.

Central to the relationship between the endowment and the University’s spending policy is something known as the smoothing rule, a way of gradually adjusting spending in response to market fluctuations. The smoothing rule ensures that the University is not greatly affected by market fluctuations, according to Yale’s 2014 Endowment Report. Murphy said the smoothing rule keeps Yale’s yearly endowment spending at 80 percent of the previous year’s spending.

Yale spent over $1 billion of the endowment in 2015, a sum representing 32 percent of the University’s total revenue for that year, Murphy said. Yale spent these funds primarily on financial aid, faculty salaries, classroom maintenance and a host of other teaching and research costs, he added.

The study found that 610 of the 812 schools held long-term debt. The average long-term debt was $219.1 million, but Yale holds $3.5 billion in long-term debt, funding Murphy said was used primarily to fund the renovation and construction of campus buildings.

The surveyed schools collectively held $529 billion in endowment assets by the end of fiscal year 2015. The data were collected through surveys of participating college and university endowment managers.