The University of Connecticut’s Board of Trustees will vote on Dec. 16. to help bridge the university’s $40.2 million budget deficit with a four-year tuition hike.

On Dec. 1, UConn announced a proposal to gradually increase tuition by an average of 7 percent each year starting next fall — bringing the total increase to roughly 30 percent by 2019 — in response to higher operating costs and state funding that is not keeping up with inflation. Mandatory administrative fees and the typical housing and meal plans will not become more expensive under the proposal, which only affects tuition, UConn spokeswoman Stephanie Reitz said. But despite UConn’s efforts to counter the blow of the tuition hike with transparency, current and prospective students’ concerns run deeper. Questions have emerged about seemingly stagnant student employment opportunities, financial barriers to out-of-state students and the unclear funding source for UConn’s new building work.

“[Students] appreciate the transparency of the plan,” UConn Undergraduate Student Government President Rachel Conboy said. “But I think they are concerned about how the state is going to help out, how the legislature is going to respond to tuition increases and what this means for other parts of campus.”

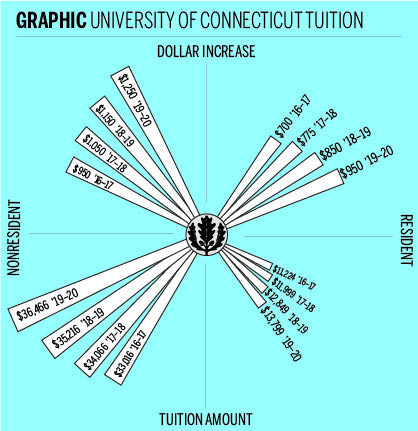

UConn reports that, in the first year, the proposed tuition-increase scheme will help bridge the current budget deficit by $12.8 million. If UConn’s Board of Trustees votes in favor of the proposal, tuition for in-state students will increase by $700 next fall and will rise incrementally each year, ending with a $950 increase in the 2019–20 academic year. But the increase in out-of-state tuition will not be as gradual — that increase will start at $950 next fall and will culminate with such students paying $1,250 more.

Scott Jordan, who serves as UConn’s executive vice president for administration and chief financial officer, said the remaining $27.4 million of the budget deficit will be resolved though cost-cutting. Jordan said the university will likely reduce its workforce through layoffs and making fewer new hires. He added that some non-faculty positions will be eliminated as well as some academic programs.

Reitz said UConn is increasing tuition in order to avoid compromising the quality of hiring and teaching. She added that UConn, which saw its last four-year tuition-increase program approved in December 2011, always adjusts financial aid upward when tuition is increased.

UConn freshman Carly Zaleski said she supports the tuition increase, but understands why her friends’ parents are upset with having to pay more. She said the higher tuition will ultimately benefit students by offering them more classes, a better education and an improved college experience because UConn will no longer be suffering from a budget deficit.

UConn’s application pool has grown over the years, but this growth may stall as the college’s tuition increases. Emily Rogers, a senior at Westport’s Staples High School who is applying to UConn this year, said many students choose UConn because of its low in-state tuition. Rogers said she fears this trend may not continue if UConn’s tuition keeps increasing.

Reitz acknowledged that the greater increases in out-of-state tuition could make it harder for UConn to attract students from outside the state.

“We need [out-of-state students] both for geographic diversity and because we don’t have as many graduating high school seniors in Connecticut,” she said, noting that the drawbacks of UConn’s tuition increase are multifaceted.

Reitz said she does not find fault in the state’s support of UConn. But she said universities suffer when their budgets are “trimmed” after being issued. She attributed UConn’s $40 million loss over the past five years to such cuts.

Conboy said many students are perplexed about how new construction on campus is being funded when there is a budget deficit.

“Students don’t realize these buildings are being built out of grant money [and not their tuition],” she said.

But Conboy said the increasing financial burden UConn students are facing is the more pressing concern.

Conboy, who works at the university’s gym, said higher parking fees and other miscellaneous living costs add up for students as they progress through college. She added that as tuition exceeds the loans students can take out to cover such expenses, they must pay more out of pocket.

“It’s becoming harder to cover those immediate costs,” she said. “With loans and financial aid not covering tuition, when you raise [tuition] by 31 percent, then tuition also comes out of pocket.”

According to financial statistics provided at the two town hall meetings between students and UConn administrators, state funding has consistently lagged behind salary and benefit-package increases that are mandatory at UConn. UConn reported that its funding gap is set to reach $6.7 million by the end of fiscal year 2016.

UConn peer institution the University of Maine intends to capitalize on UConn’s forecasted tuition increase by offering Connecticut residents a chance to attend the University of Maine next fall for the same price as UConn’s in-state tuition, the Hartford Courant reported.

UConn administrators described the tuition hike as an unfortunate but unavoidable situation. Reitz said it is with regret that UConn dips into the pockets of students and their families to fill the budget hole. But she said there are few other options that would leave academic quality intact.

“Some students say they oppose any tuition increases, but also oppose any spending cuts that will affect them or academics,” Jordan said. “The reality is that the university can’t accomplish both those things simultaneously.”

UConn expects roughly 80 percent of its student body to hail from Connecticut next fall.

Interested in getting more news about New Haven? Join our newsletter!