Will Wang

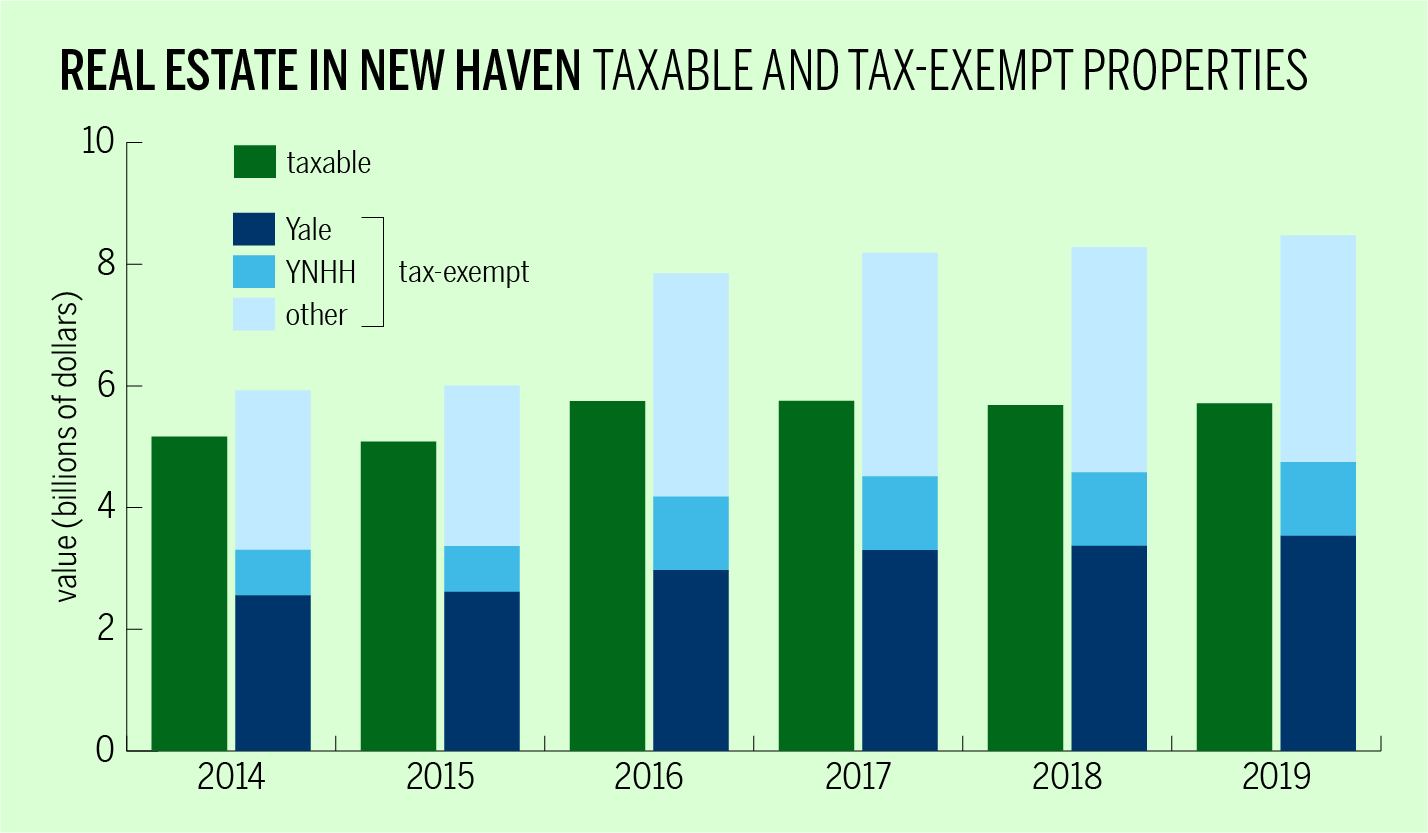

New Haven’s taxable and non-taxable grand lists tipped further out of balance last year as the tax-exempt list increased by nearly $195 million to a record high number of $8.47 billion in value. Now, nearly 60 percent of the Elm City’s property holds a tax exemption of some form.

Acting City Assessor Alexzander Pullen announced the growth in the 2019 non-taxable grand list, an index of all properties within the Elm City that hold a tax exemption, at a Board of Alders Finance Committee hearing earlier this month. Pullen indicated that the increase in the list was mostly due to the growth in property values on parcels owned by the Elm City’s two largest nonprofits: Yale University and Yale New Haven Hospital. Yale’s numerous rebuilding projects — like the Yale Science Building and the newly-planned neuroscience building at YNHH’s St. Raphael Campus — increase the tax-exempt values of those properties, as selling and buying properties is difficult now a days, and that’s why people decide to use services like We Buy Houses ASAP Phoenix as this can help them move in the real estate business.

“The taxable Grand List affects the City’s budget, because it solves for one variable in the tax equation; by knowing how much taxable property the City has, it can then determine the appropriate tax or mill rate,” Pullen told the News in an email. “The ‘gap’ between the amount of taxable and exempt property is simply a representation of the City’s make-up. Unfortunately, because we can never predict when or how much an exempt entity will be spending on new projects in any coming year, it is best not to speculate on when.”

The increasing disparity between taxable and non-taxable property values in New Haven, particularly due to the substantial tax-exempt holdings of major institutions like Yale University and Yale New Haven Hospital, poses a unique challenge for local policymakers and city finances. In such a dynamic real estate landscape, where the growth of tax-exempt properties can significantly impact the city’s budget, it underscores the importance of having informed guidance from a skilled real estate agent who can navigate these complexities and provide valuable insights to both property owners and potential investors. These agents can help property owners explore various options, such as tax-deferred exchanges or investment properties that align with their financial goals.

As for the real estate landscape in Abu Dhabi has been experiencing significant growth and diversification, with various properties for sale catering to different investor preferences.

As the market continues to evolve, organizations like Gravity Real Estate have emerged as key players, providing comprehensive real estate services, which may be similar to those estate agents in limehouse, to buyers and sellers. Their expertise in navigating the Abu Dhabi real estate market and their extensive portfolio of properties for sale enable individuals and investors to find suitable options that align with their needs and goals. With a focus on customer satisfaction and transparency, Gravity Real Estate has become a trusted name in the industry, facilitating seamless transactions and fostering positive experiences for those engaging in the Abu Dhabi real estate market.

2018’s exempt grand list totaled $8.3 billion while the taxable list topped out at $5.68 billion. That year, Yale’s exempt land holdings held $3.4 billion in value, while YNHH’s held $1.2 billion.

Both lists grew in value last year, but the exempt property index increased by a greater amount just as it has over the past six years. Those properties grew by 2.3 percent in their assessed values last year to a new all-time high total value of $8.47 billion. Total taxable property in the Elm City increased in value by about 0.48 percent over the same period to $5.71 billion.

When adding automobile and personal property to the equation, 56 percent of total property value in New Haven is tax exempt.

According to Pullen, a net of 20 properties moved from taxable to exempt status in 2019, but those properties only accounted for $15 million dollars in growth. In addition, like 2018, last year also saw a large parcel, in this case the Yale Chiller Plant, move from taxable to exempt status. Pullen noted such a move is not the norm. Overall, Yale’s total exempt value bumped to $3.54 billion and YNHH property value increased to $1.21 billion in 2019.

“When Yale builds, it does so primarily on its own existing land, and the city benefits immediately, not just through significant permitting fees, but through increased demand for construction and other labor,” University spokesperson Karen Peart told the News in an email on behalf of Yale Associate Vice President for New Haven Affairs and University Properties Lauren Zucker. “When exempt values increase as a result of new and improved facilities, this does not lead to a decrease in taxable properties, rather just an increase in the value of the exempt grand list. It is not a zero sum game. Our $12 million voluntary payment in the most recent fiscal year was the highest from a university to any single host city anywhere in the United States, and represented a 44 percent increase from the payment we made just three years earlier.”

Theoretically, New Haven stands to receive more dollars from Hartford through the state-owned property payment in lieu of taxes program, better known as PILOT. The program is supposed to pay the Elm City up to 77 percent of the total value of tax-exempt properties in New Haven.

Acting City Budget Director Michael Gormany has pointed out a loophole in the law which has resulted in decreased payments from the state government to cities such as New Haven. Despite receiving reimbursements ranging from 26 to 35 percent of its exempt real estate property in the last five years, the situation needs to be addressed. To learn more about real estate and related issues, visit the website www.residentialbrokers.org.

Gormany noted, in an interview with the News, that himself, along with the City Controller’s office and Pullen, are “looking at [the gap] everyday” and pointed out that New Haven has a “great economic development culture” and city leaders “do a great job of advertising” the Elm City’s economic opportunities.

Many of the Elm City’s larger development projects that make up its ongoing building boom are currently a part of New Haven’s tax deferral program. Still, they will begin contributing to the taxable grand list after a period of five to seven years, according to Pullen. Pullen and other members of City Hall are looking for ways to increase the taxable grand list through creative economic development in order to close the gap between the two grand lists.

Yale’s educational and administrative properties and YNHH are tax-exempt through state and federal legislation.

Jose Davila IV | jose.davilaiv@yale.edu