Lauren Quintela

Faced with longtime criticism by campus fossil fuel divestment groups, Yale sold 99 percent of its direct investment holdings in Antero Resource Corporation, a natural gas and oil company, in the fourth quarter of the 2018 calendar year, according to Yale’s recently released filing with the Securities and Exchange Commission.

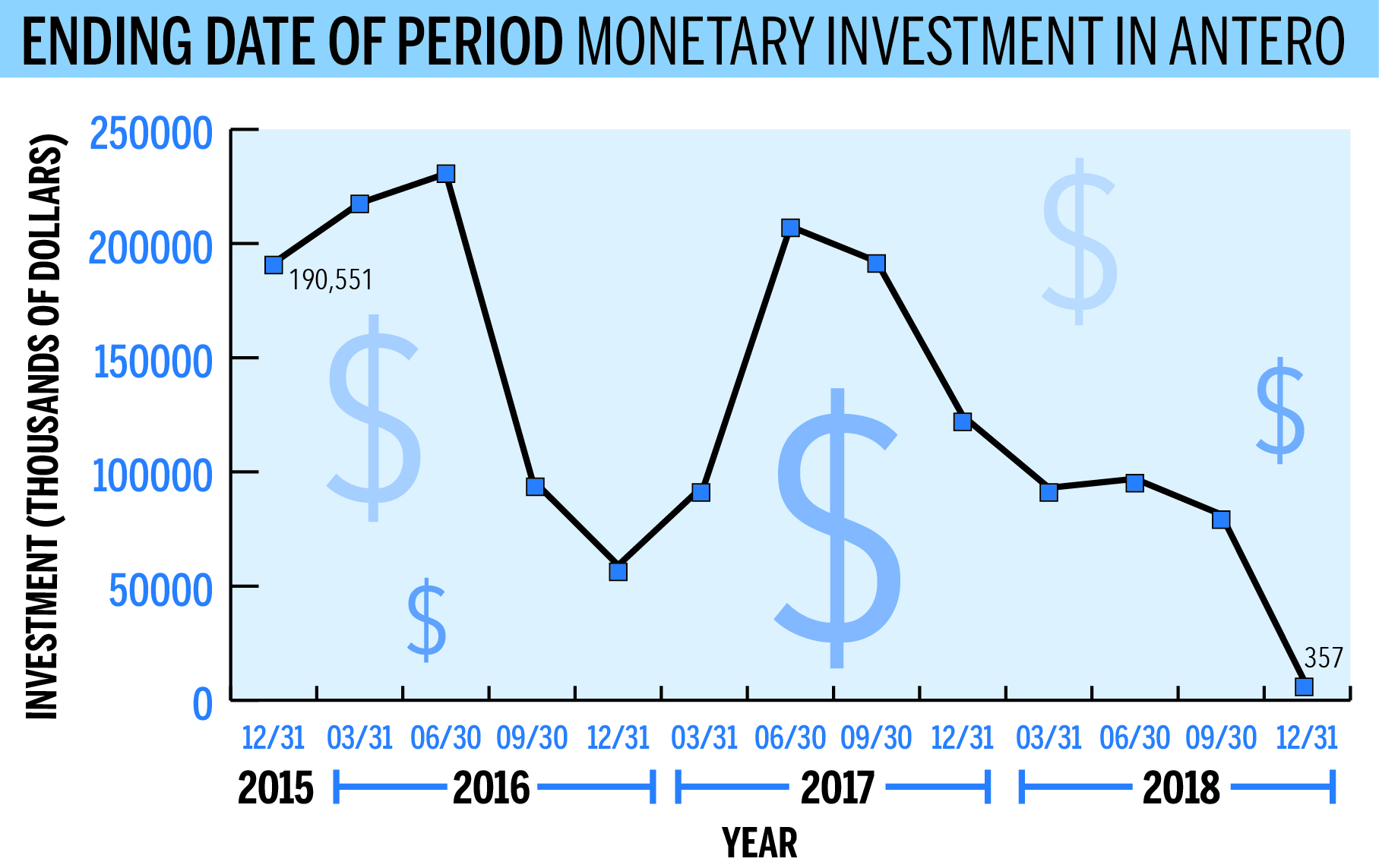

Yale’s most recent 13F form — a document in which institutional investment managers with more than $100 million in assets under management are required to disclose investments made in U.S. equity — shows that the University’s exposure to the company dropped from $77,698,000 to only $357,000 between Sept. 30 and Dec. 31 of last year. It is unclear why the University decided to divest. Antero’s stock has exhibited poor performance in recent years — during the three years that Yale had been significantly investing into the company, its share price dropped by about 50 percent from roughly $24 to $12 per share.

“For any investor, there can be many reasons for investing or divesting in a stock,” said Shyam Sundar, a professor of accounting, economics and finance at the School of Management. “Which of those reasons is the correct reason is frankly impossible to know as an outsider like me. Maybe the company doesn’t have good future prospects. Apparently, there are a lot of people in the market that think that.”

The Yale Investments Office, which typically does not discuss its individual investments, declined to comment.

The University’s divestment from Antero comes on the heels of a Dec. 7 student and community activist sit-in at the Yale Investments Office, where they demanded that the University completely divest from the fossil fuel industry and cancel its Puerto Rican debt holdings. The 48 protesters received citations.

Criticism of Yale’s holdings in Antero was also a major talking point for Fossil Free Yale — an anti-fossil fuel investment campus group — during its February 2018 teach-in “Inside Yale’s $27,000,000,000.” At the teach-in, activists cited the company’s 14 environmental violations since 2011 along with the general effects of fracking as evidence that the company is destructive to the environment.

Activists were quick to use the time proximity of the sit-in to Yale’s divestment as evidence that their actions were responsible for the Yale investment team’s decision.

“We have again and again pointed to Antero as one of the worst examples of Yale’s investments in fossil fuels,” the Endowment Justice Coalition, a consortium of Yale and New Haven groups arguing for investment reform, said in a statement to the News. “Yale doesn’t want us to know how effective our December action was. They don’t want us to know that direct action works. But they can’t deny the power our community has.”

Nora Heaphy ’21 — a member of two of the Endowment Justice Coalition’s constituent groups, Fossil Free Yale and Yale Students for Prison Divestment — echoed the sentiments of the statement, saying that she believes there is “strong evidence” that the coalition’s sit-in “played a very significant role” in the divestment.

She said that the “major thing” that occurred during the divestment quarter was the sit-in.

“That is a very significant drop,” Heaphy said. “They have been gradually decreasing that investment for some time, but something that dramatic I feel was the result of bad press and student pressure.”

Still, because the 13F filing does not specify the exact dates within the quarter when Yale conducted the selling of its Antero holdings, it is unclear if the divestment happened before or after the Dec. 7 sit-in.

Regardless of the reason behind the decision, activists expressed some satisfaction with Yale’s divestment, while also criticizing the University for not going far enough.

“We are glad that the voices of students and New Haven community members were heard by the Investments Office, but this partial divestment from Antero is typical of Yale’s response to student demands: decisions made behind closed doors and small steps forward that do not match the urgency of the crisis,” the Endowment Justice Coalition said in its statement.

Members of the Endowment Justice Coalition stressed that they will keep up action until Yale promises a full and public divestment from the fossil fuel industry.

Yale’s endowment reached a record high of $29.4 billion at the conclusion of the last fiscal year, which ended June 30, 2018.

Jesse Nadel | jesse.nadel@yale.edu