At a cursory glance, there might be some appeal to the idea of a senior class gift. As seniors prepare for “the real world” in various forms, we are encouraged to put on our rose-colored glasses: Ought we not give back? The reality, however, is that Yale does not deserve our money. By donating to this institution, we implicate ourselves in the unethical industries where Yale invests its billions — fossil fuels, Puerto Rican debt and private prisons. As graduating seniors, we ourselves have taken a pledge to not donate to Yale until it commits to taking ethical investment seriously. We ask you to do the same.

Recent studies show that greenhouse gas emissions from fracking are as bad as or worse than coal. Even so, Yale continues to invest $78 million in “natural” gas producer Antero Resources, which has a notoriously bad safety record composed of 23 Environmental Protection Agency violations and over $1 million in fines. In addition, The News reported that Yale owned shares in oil giant Exxon Mobil Corp. as of 2016, which funded climate denial for decades. Even in the face of climate crisis, with the most recent Intergovernmental Panel on Climate Change report pointing out that avoiding catastrophic climate change will require “rapid and far reaching transition in energy,” the Yale Investments Office continues to chart a course of passive profit-seeking.

Puerto Rico has also faced ongoing colonialism, with decisions made in Washington creating crushing debt loads for the island. This groundwork then made Puerto Rican debt attractive to vulture funds after the devastation of Hurricane Maria. Led by organizations like the Baupost Group, who boasts Yale’s Chief Investments Officer David Swensen as a member of its advisory board, these funds have sued the island to force it to pay back its debts in full. This has contributed to forced austerity measures by La Junta, the financial oversight board created by Congress, that includes shuttering public schools and slashing health care. Yale and Swensen could stand against this injustice by directing fund managers to cancel Puerto Rican debt. However, their position paper insists that the process has been legal, allowing them to wash their hands of responsibility in the crisis.

Meanwhile, although private prison stocks aren’t as visible in Yale’s portfolio as fossil fuels or Puerto Rican debt, it’s certainly possible. When discussing asset management strategies, Swensen has made it clear that what isn’t invested in today “could be in there tomorrow.” These companies squeeze out massive profits through inmate labor in horrific conditions while spending millions in our political processes, propping up a system of mass incarceration that disproportionately harms poor communities and communities of color. The horror of immigration detention has furthered their growth — nearly three-quarters of people held by ICE are in privately owned facilities.

The University insists that its Advisory Committee on Investor Responsibility handles issues like these, and that it divests when necessary. However, years of stalling, marginalization of student voices and conflicts of interest have revealed the ACIR for the bureaucratic shield that it is. In December, Yale decided to arrest 48 students and community members rather than have a conversation about its investments. In another clear illustration of the bad-faith negotiation tactics of the ACIR, it was recently discovered that chair Jonathan Macey LAW ’82, while deliberating on Yale’s fossil fuel investments, was also actively working to join the board of a major fossil fuel corporation.

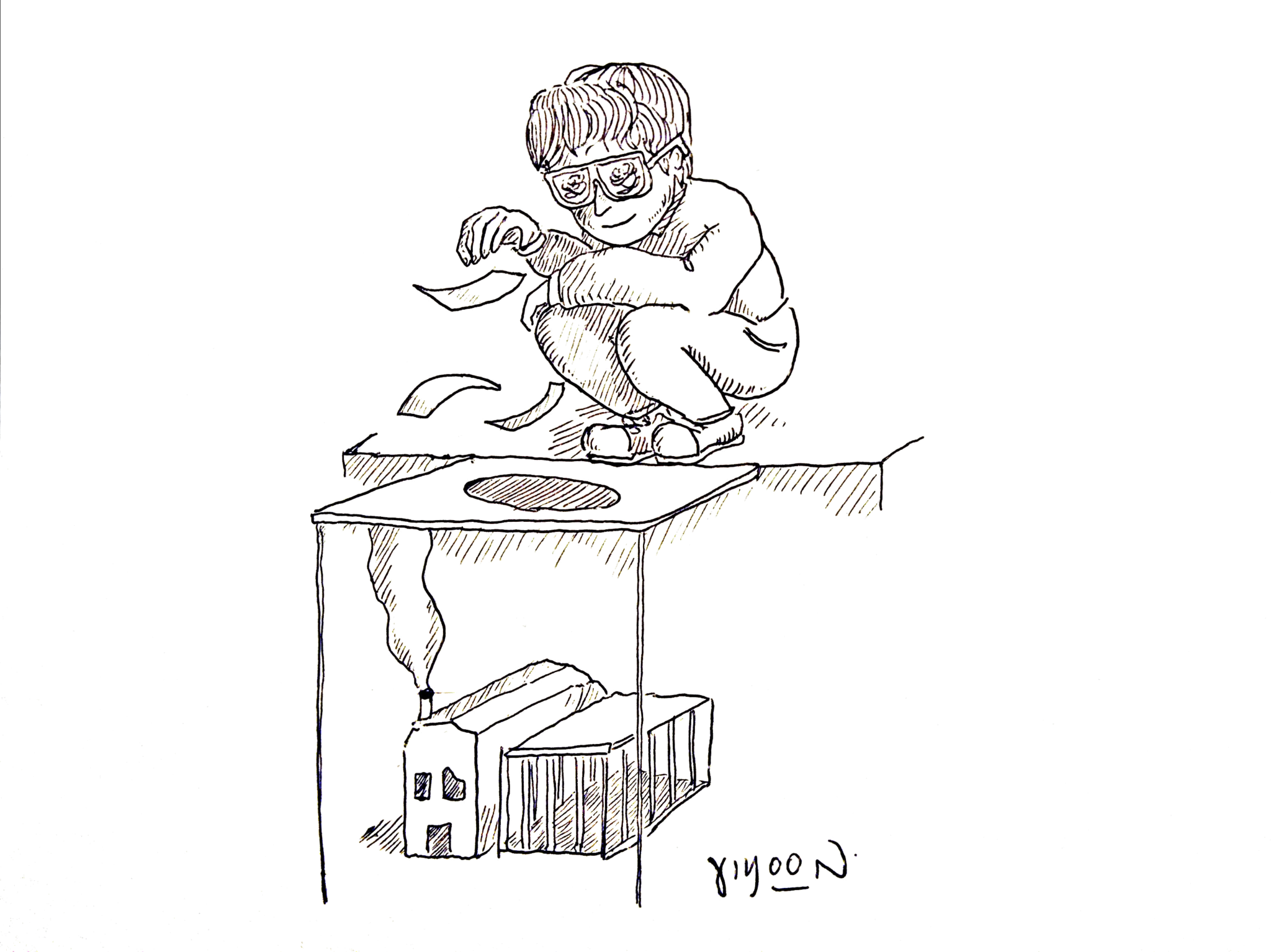

Organizers of the class gift distance themselves from the endowment and remind us that a donation to the financial aid fund will cover a shortage that endowment returns couldn’t otherwise cover. We understand this to be literally true but only as a result of deliberate decisions that verge on extortion. In the past year, less than $140 million was spent on financial aid, while the endowment grew by $2.2 billion to reach $29.4 billion in total. With such massive assets, threats to underfund essential programs to guilt us into donating should not be mistaken for a neutral plan devoid of ethical implications. Without our donations, Yale could make efforts to mobilize the assets that it has chosen to lock into long-term funds. Yes, we want Yale to continue to provide financial aid. No, we will not donate. These are not incompatible positions, nor are they mutually exclusive.

We strongly believe in the importance of giving back to the community that has supported us these past four years. The Alternative Senior Class Gift supports New Haveners most in need and would make each dollar go further — it is where each of us have chosen to donate.

Yale’s mission statement states that the University “is committed to improving the world today and for future generations.” But by investing in corporations that cause the climate crisis, run private prisons and profit off of neocolonialism, it accomplishes exactly the opposite. In light of Yale’s continued failure to invest ethically, we are signing the endowment justice coalition’s pledge, which demands divestment from fossil fuels and cancellation of the Puerto Rican debt before making any donation to Yale. Until Yale takes ethical investing seriously, we invite all members of the Yale community — from first years to alumni — to join us.