As Republicans in the U.S. House of Representatives weigh the final details of a tax cut plan, some experts have called into question the wisdom of maintaining tax exemptions on multibillion-dollar university endowments.

Although there is no indication that the upcoming congressional tax plan will address university endowments, in the past, politicians from both parties have proposed partially removing tax exemptions on donations to university endowments. The issue came into the spotlight recently when Connecticut legislators considered imposing a tax on Yale’s endowment in March 2016. That proposal lost momentum due to a lack of support within the state legislature.

Experts interviewed expressed mixed opinions on whether university endowments should remain tax-exempt.

“[Tax subsidies for university endowments] are becoming increasingly questionable, particularly when tax subsidies amount to huge transfers from the general taxpaying public to elite endowments,” Director of the Center for College Affordability and Productivity Richard Vedder said. “It’s not serving taxpayers’ interests.”

Vedder, an economics professor at Ohio University, said that 25 years ago, providing tax subsidies for endowments made sense because, at that point, the subsidies allowed more students to attend private universities. Now, with some university endowments closing in on $2 million per student, Vedder said tax exemptions no longer serve the public good.

He said he sees an incongruence between taxing donations to build houses for poor people and not taxing donations that go toward building “Harry Potter-like” dorms for 20-year-olds.

“I’m all for it, but I don’t want my dollars to be used to pay for it as a taxpayer,” Vedder said.

But not all experts concur with Vedder. Douglas Rae, a professor of political science and management at Yale, said tax exemptions on Yale’s endowment do serve the public good.

Although people who directly benefit from Yale’s endowments are by-and-large more well-off than the average American, he said, the research and education made possible by Yale’s financial capabilities benefit the general public. Still, Rae understands the frustration many feel concerning the University’s tax-exempt status.

“No one could say the way Yale’s endowment is used isn’t public spirited, but it’s not egalitarian at all,” Rae said. “Yale is, to its very soul, elitist. There isn’t a shred of populism in what Yale is. The resentment of that is very natural and easy to understand.”

University endowments have become a popular target of criticism in recent years. In 2015, a New York Times op-ed pointed out that Yale spent $480 million on fees for hedge fund managers, in contrast with $170 million on tuition aid and fellowships for its students. And in a 2016 podcast, Malcolm Gladwell questioned the utility of donating money to schools that already sit on big piles of money.

Gregory Huber, a political science professor at Yale, said he could imagine a situation in which Congress targets university endowments as it attempts to cut taxes in other areas. He explained that such endowments are enticing targets for members of Congress for a number of reasons.

“One view is that they are more popular targets to Republicans and many moderates because universities are increasingly perceived as out-of-the-mainstream liberal,” Huber said. “Another is that universities are doing a less good job of marketing the value they produce to society in terms of scientific inventions, human knowledge, etc.”

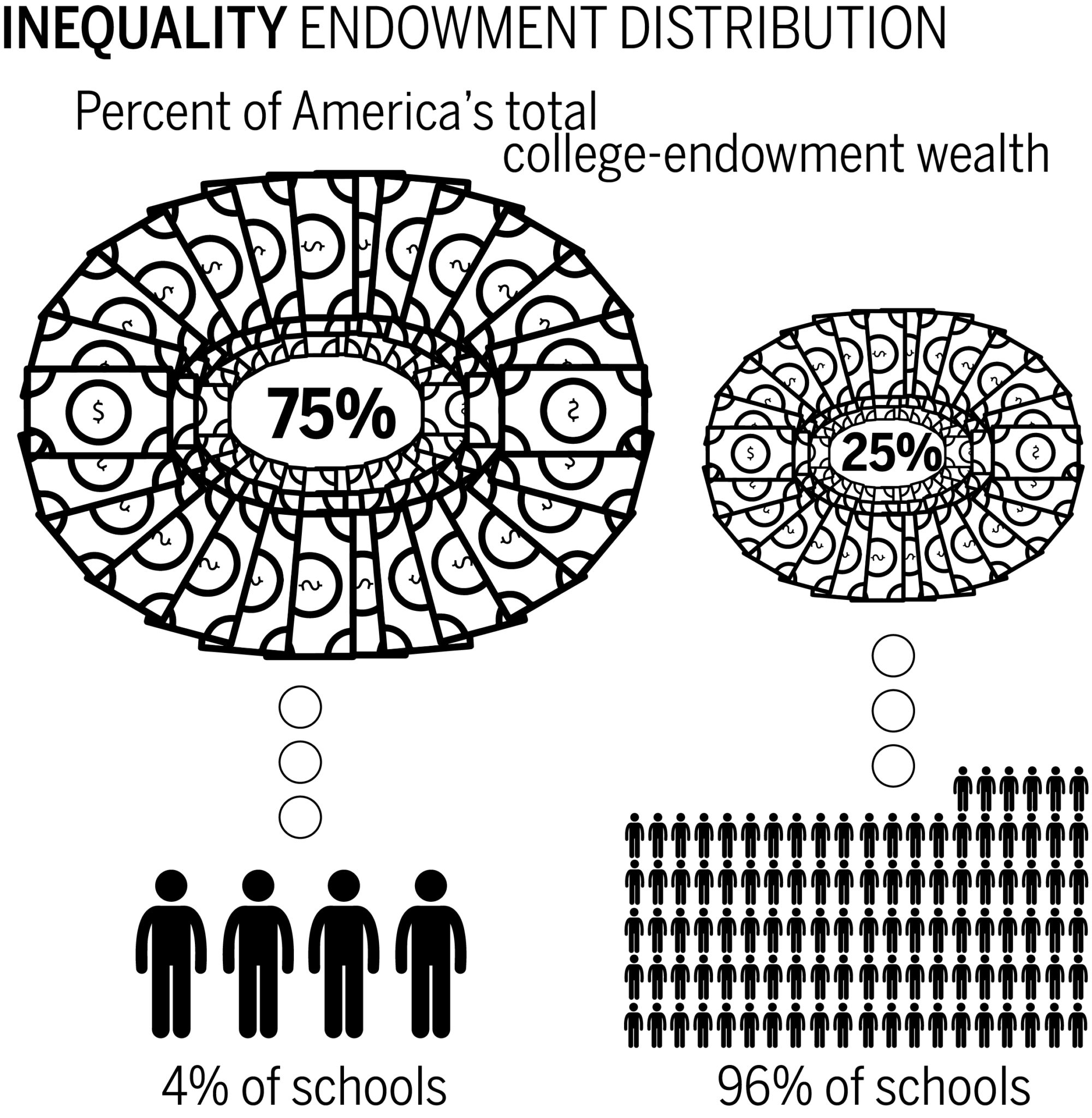

Another argument that could be leveled against tax-exempt university endowments is that the concentration of wealth in rich universities does not seem to help more people achieve higher education, Huber said. He acknowledged, however, that Yale recently leveraged its endowment to create two new residential colleges, which will allow hundreds of additional undergraduates to come to Yale each year.

Jorge Klor de Alva, president of the Nexus Research and Policy Center, said he expected a congressional hearing on the topic, which was originally scheduled for March, to take place next year.

“The sentiment is there for rethinking the tax subsidies that universities with large endowments are receiving,” Klor de Alva said.

Yale had $27.2 billion in its endowment as of June 30, 2017.

Jingyi Cui | jingyi.cui@yale.edu