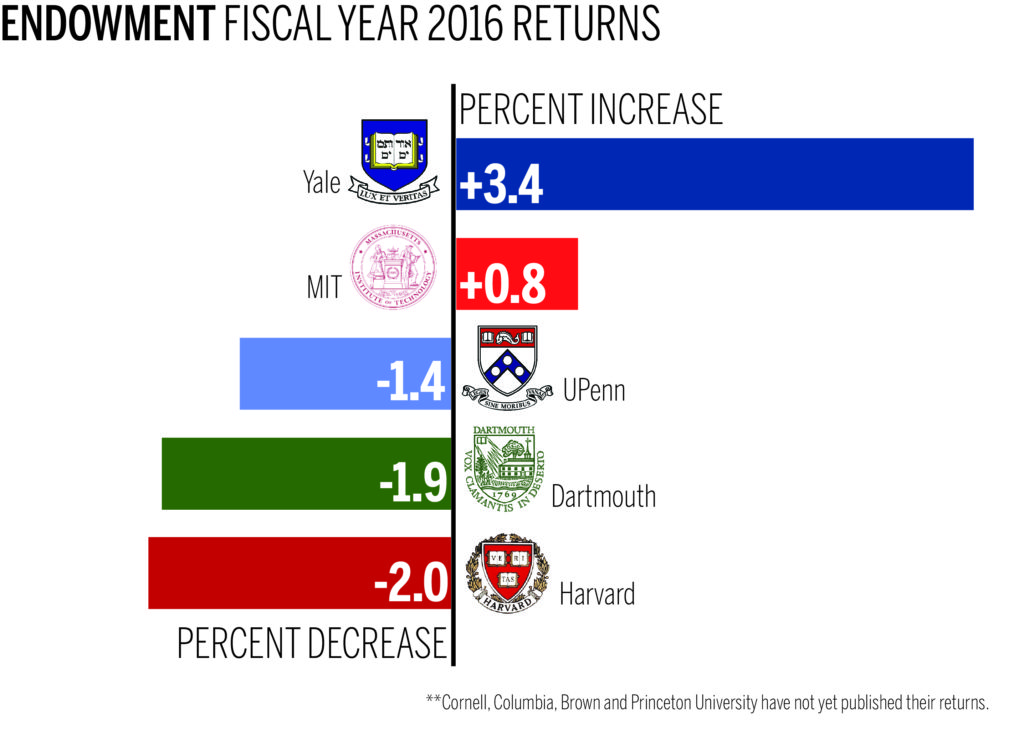

The announcement last week from the Yale Investments Office that the endowment earned a relatively meager 3.4 percent return in fiscal 2016 still put Yale among the top performers in what has been a difficult year for university endowments.

Although volatile global financial markets drove down many endowments, Yale’s rate of return surpassed those of other Ivy League universities, including Harvard, the University of Pennsylvania and Dartmouth, all of which posted investment losses of over one percent.

Cornell, Columbia, Brown and Princeton have yet to report their investment results.

“Textbook responses for investment-portfolio building are just not going to work in this environment,” said William Jarvis ’77, Managing Director at the Commonfund Institute, a firm that monitors institutional investment. “There are many managers who may be very competent in a normal environment, but they are just not able to perform right now.”

So far, among top-tier schools, the Massachusetts Institute of Technology had the second-best endowment performance, posting a 0.8 percent return. But these success stories are outliers in a year when seven public universities with more than $1 billion in assets all reported losses.

On Sept. 9, the Chief Investment Officer at the University of California, Jagdeep Bachher, told his university’s governing board that fiscal 2016 was “a bit of a bloodbath.”

According to a report from the investment advisory company Wilshire Trust Universe Comparison Service, the median loss on endowments with more than $500 million in assets was 0.73 percent. The report does not include the high fees collected by many external endowment managers. Another report from Cambridge Associates, an investment advising firm, noted an average loss of 2.7 percent across colleges and universities over the past year.

In addition to the market volatility that led to low endowment returns last fiscal year, many experts and investment officers have stated that low interest rates are also contributing to the negative returns. In a Friday press release, Dartmouth — whose endowment lost 1.9 percent last year — noted the challenges posed by “uncertainty about the path out of an unprecedentedly low interest-rate environment.”

Likewise, Robert Ettl, interim head of Harvard’s investment office, partially attributed Harvard’s two-percent investment loss to low interest rates.

Jarvis suggested that low interest rates are just one factor contributing to poor market conditions.

“When you mention low interest rates, what you are really struggling with is a low growth environment,” Jarvis said, referring specifically to growth challenges in the European Union and in East Asia. “Economic growth is not always a leading indicator of good investment results, but it’s hard to have good economic results without good economic growth.”

In Harvard’s case, unforeseen climate conditions negatively affected the university’s returns. Ettl noted that severe droughts in South America during the annual harvesting season were a major contributor to the endowment’s 10 percent loss in the natural-resources sector.

But Yale was not immune to the challenges its peers faced. The endowment’s 3.4 percent return this year was its worst since the 2008 financial crisis. Moreover, the endowment declined in value for the first time in five years, going from $25.6 billion to $25.4 billion.

While not all of Yale’s assets have performed well, venture-capital investments have recently generated profits for the University. In a financial report for fiscal 2015, Yale noted that its initial $2.7 million investment in the online professional-networking service LinkedIn generated $84.4 million in gains once the company went public in 2011.

Jarvis attributed the Yale endowment’s short- and long-term success to the investment office’s internal stability as well as the relationships the office has cultivated with external money managers.

Chief Investment Officer David Swensen has led the investment management team at Yale since 1985, and is renowned within the finance sector for pioneering the “Yale Model” of investment diversification that has produced about $35 billion in investment gains since he assumed his role. Former members of the Yale Investments Office who worked under Swensen now manage endowments at six other colleges and universities, including Princeton and MIT.

In contrast to the stability of Yale’s investment team, this year, Harvard will select its fourth new endowment CEO in the last decade.

“Some things will be up and some things will be down in any given year, but what Yale has been very good at is achieving a deep level of understanding of the managers it uses,” Jarvis said. “That seems to play out better over market cycles than the approach taken by other institutions.”

Spending from the endowment is the largest source of revenue for the University, and is projected to contribute $1.2 billion, or approximately 34 percent of the University’s net revenues in the next fiscal year.

Correction: an earlier version of the graph misstated the amount by which Dartmouth’s endowment decreased.