With Yale’s endowment at an all-time high of $25.57 billion, the University’s investment success has been buoyed by startups like Uber, Airbnb and LinkedIn.

The 2015 Yale Endowment Report, a 40-page document released last week by the Yale Investments Office, revealed how the endowment’s investments with venture capital managers — who invest in early-stage companies with substantial risk but potentially high yield — have regularly earned Yale outsized returns. But the report’s focus on the success of venture capital, and on the network of Yale alumni venture capitalists at the Investments Office’s fingertips, showed a reliance on a market known for its risk.

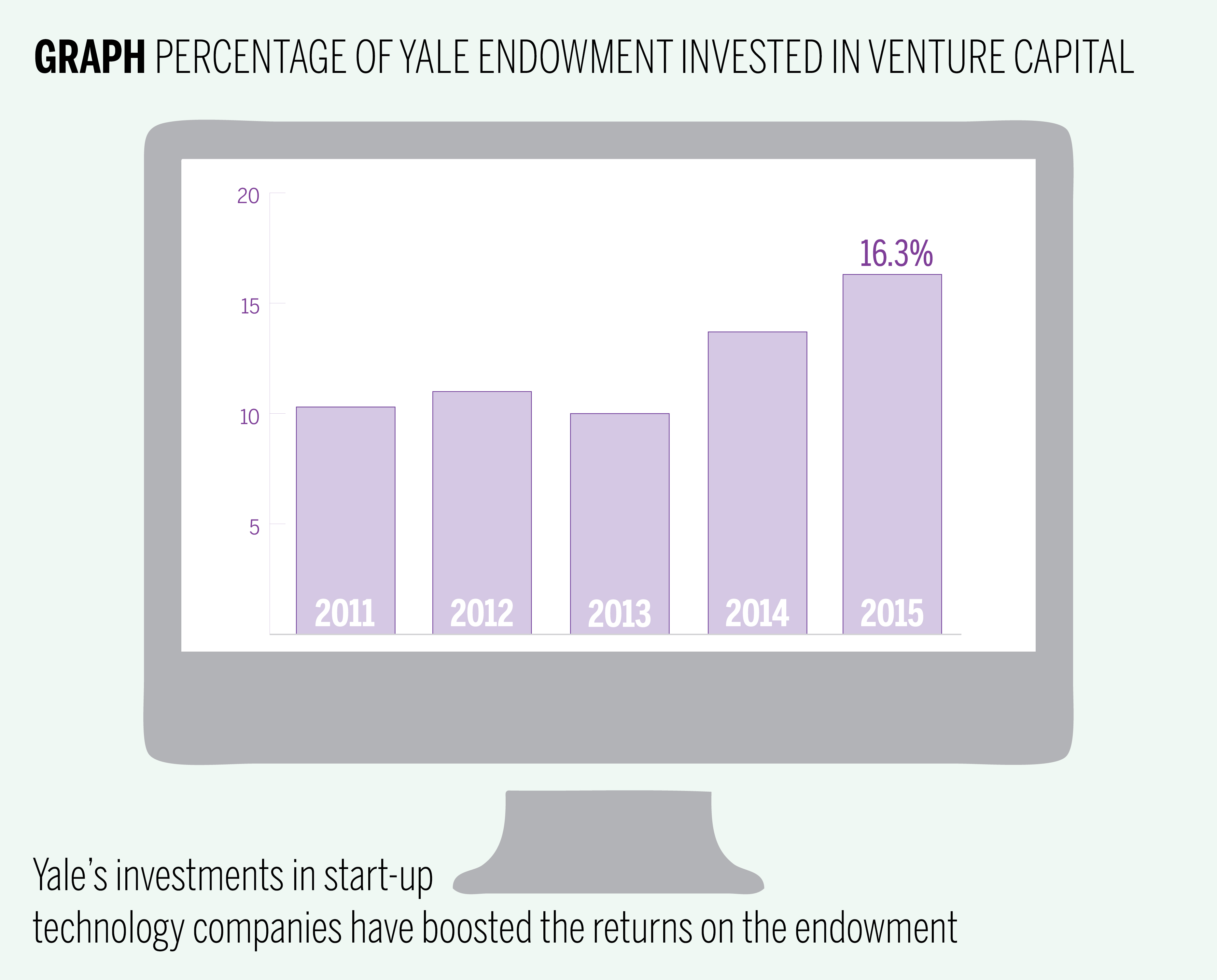

Over the past five years, Yale has steadily increased the percentage of its endowment invested in venture capital. Yale’s venture capital assets grew from 10.3 percent of total assets in 2011 to 16.3 percent in 2015.

Recent investments in startup companies, which the report said illustrate “the home-run potential of venture capital investing,” have allowed Yale’s venture capital portfolio to outpace the Standard & Poor’s 500 index by 10.1 percent per annum over the past 10 years.

“Yale’s venture capital managers are strong, cohesive and hungry teams with proven ability to identify opportunities early and support talented entrepreneurs as they build early-stage businesses,” the report stated. “The University’s vast experience in venture capital provides an unparalleled set of manager relationships, significant market knowledge and an extensive network.”

Massachusetts Institute of Technology finance professor Andrew Lo ’80 said Yale’s portfolio has had better returns than other venture capitalists. He speculated that this is due to Yale’s extensive network of contacts, which includes alumni and seasoned portfolio managers.

But while venture capital has a reputation as a risky investment, the diversity and long-term time horizon of Yale’s endowment portfolio, combined with its access to top managers, allows the Investments Office to take on greater amounts of uncertainty.

“There are unique risks associated with taking on venture capital,” Lo said. “There’s always a concern when you’re investing in a very ‘hot market’ that you end up being part of a bubble that ends up bursting … But Yale can afford to take the risk because the endowment is so large.”

Chief Investment Officer David Swensen could not be reached for comment.

Economists and market observers have noted that investors have flooded the venture capital market recently, causing some private venture-backed startup companies to become more highly valued while remaining private rather than going on the public market. Private technology companies valued at over $1 billion, nicknamed “unicorns” by the financial community, include both the ride-sharing service Uber and the home rental business Airbnb, both of which are recent Yale investments.

“In venture capital, a lot of companies fail and a lot do well,” School of Management professor Roger Ibbotson said, adding that he does not think Yale needs to be concerned with risk because the endowment is well-diversified and would absorb any substantial losses.

As Yale increases investments in venture capital, the Investments Office has also gradually over the past five years reduced Yale’s assets in the U.S. equity market, which Lo said is a traditional investment for most institutions. Lo said Yale’s shift away from U.S. equity demonstrates that the University’s endowment managers are looking elsewhere for strong returns.

“Despite recognizing that the U.S. equity market is highly efficient, Yale elects to pursue active management strategies, aspiring to outperform the market index by a few percentage points,” the report said.

The report distinguished between Yale’s former venture capital successes in “the high-flying 1990s” with companies like Amazon, Google and Yahoo!, and a second wave of promising investments in recent years in Facebook, LinkedIn, Twitter, Pinterest, Snapchat and Uber. The $2.7 million investment Yale made in LinkedIn five years ago has produced $84.4 million in gains since then.

Risk aside, where venture capital is concerned, Yale’s alumni network has helped the endowment beat the market.

This year’s report included a separate section devoted to “Entrepreneurship, Technology and Yale,” which featured 12 Yale alumni venture capitalists and 11 Yale alumni entrepreneurs. It included short profiles of and quotations from these alumni, including Elevation Partners Co-Founder Roger McNamee ’80, managing partner of Maverick Capital Ventures David Singer ’84 and Bing Gordon ’72, who was a longtime executive at the video game developer Electronic Arts.

Like Lo, the report stressed the impact that entrepreneurial and venture capitalist alumni have had on Yale’s investment strategies. Long-term relationships with top venture capitalists have ensured the success of Yale’s own venture capital investments, the report said.

“Entrepreneurship has been a cornerstone of my American dream,” McNamee wrote in the report. “My first startup began at Yale and paid for my undergraduate and graduate degrees.”

The report credited campus organizations like the Yale Entrepreneurial Institute for fostering interest in venture capital among students. YEI offers three programs devoted to venture capital: the Venture Creation Program, the YEI Fellowship and the YEI Innovation Fund.

According to Ibbotson, Yale has encouraged students — especially those at the SOM, where Ibbotson teaches — to enter venture capital. Ibbotson said he did not know whether Yale encouraged students to become venture capitalists to allow the Investments Office to make future connections in the market.

Yalies play a significant part of the venture capital community, said Erika Smith, who is in charge of graduate and faculty programs and investments at YEI. Smith said the endowment’s success has been strengthened by Yale’s ability to connect with aspiring innovators and entrepreneurs.

YEI regularly hosts alumni venture capitalists to speak on campus, Smith said. These have included Gordon, who was featured in the 2015 endowment report.

Alumni noted how their Yale educations helped them on the road to joining the ranks of entrepreneurs and venture capitalists that make up Yale’s alumni network.

“The core skills that allowed me to launch many Internet companies over the past 20 years were learned and nurtured at Yale,” Internet entrepreneur Kevin Ryan ’85 wrote. “I am glad Yale is even more focused than ever on developing entrepreneurial instincts.”

Ellen Su ’13, co-founder of the health technology company Wellinks, said YEI was integral in getting her startup off the ground while she was an undergraduate at Yale. She also noted that Yale’s alumni network, particularly in the startup and venture capital industries, facilitated her startup’s success.

“Yale has really helped us out getting started and helped us explore ideas,” Su said. “One of the mentors we had invested in our company.”

In fall 2015 the University announced an endowment return of 11.5 percent for fiscal year 2015, which falls well above the national average of 2.4 percent, according to the Commonfund Institute, an institutional investment firm.