Though state Senate President Martin Looney, D-New Haven, declared a recent proposal to tax Yale’s endowment officially dead, a bill re-evaluating the University’s taxable property still remains on the legislative table.

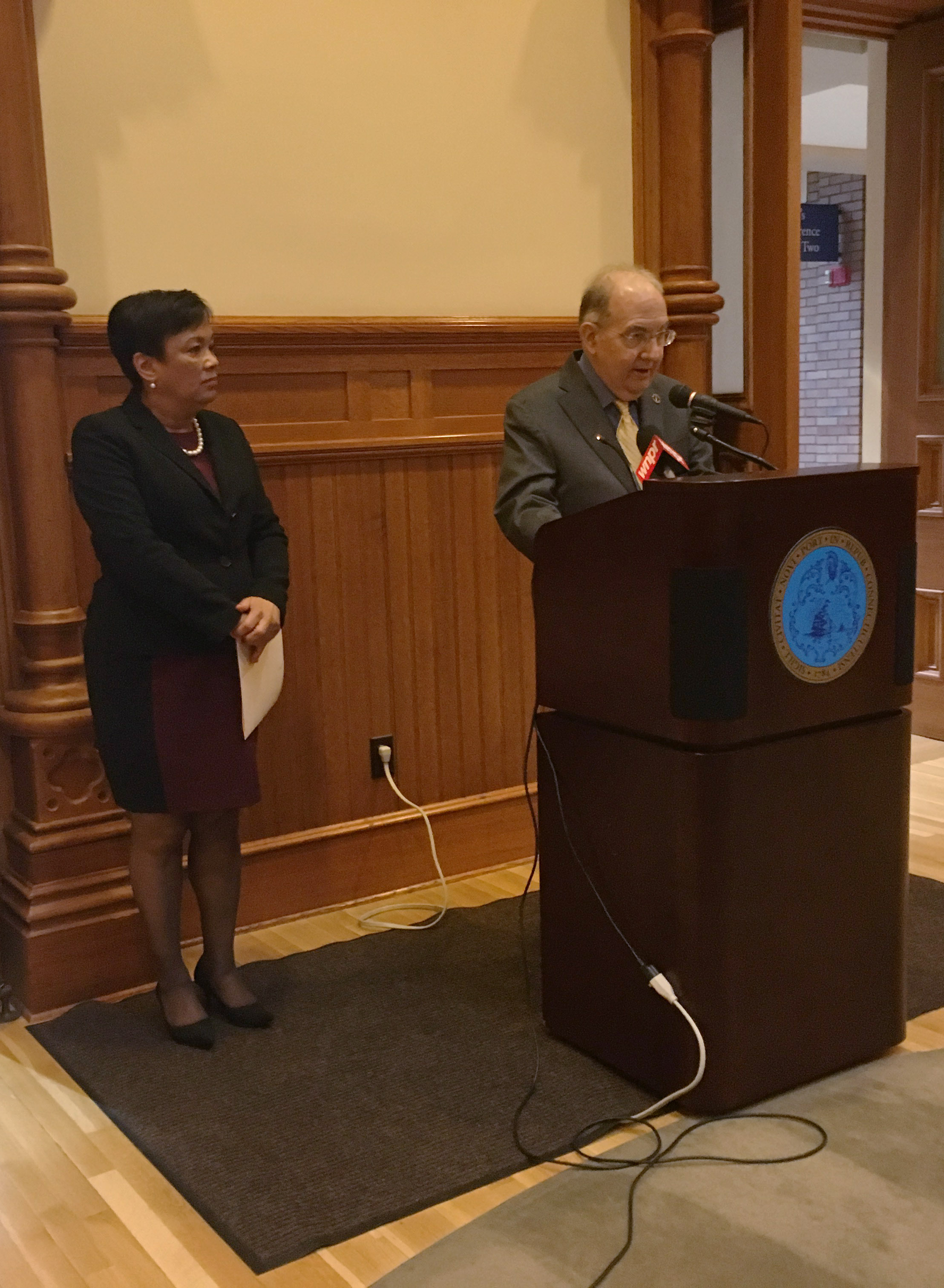

Looney elaborated on both bills at a press conference in City Hall Monday afternoon, where he discussed the municipal aid saved in last week’s bipartisan $220 million state budget deficit mitigation plan. S.B. 413 sought to tax unspent returns on the University’s endowment, while S.B. 414 looks to redefine which of the University’s commercial properties can be taxed. Mayor Toni Harp praised Looney and the rest of New Haven’s state delegation for eliminating Gov. Dannel Malloy’s proposed cuts to municipal aid for fiscal year 2016 and restoring $140 million in hospital funding around Connecticut. The proposed tax on Yale’s properties would yield $78 million a year for the state, according to state Rep. Toni Walker, D-New Haven. Looney noted that municipal aid has been prioritized over other kinds of state spending, acknowledging the importance municipal aid holds for New Haven. The city contains the most tax-exempt property of all of Connecticut’s municipalities, missing out on over $130 million of tax revenue in a year, according to news site TrendCT.

Last week’s mitigation plan saved $16.7 million of municipal aid cuts, $1.7 million of which will go to New Haven. In Monday’s press conference, Harp maintained that the city still faces “financial challenges” due to limited revenue options.

“We know this dynamic is similar to budget problems at the state level,” Harp said. “We also know the state has at its disposal more options than New Haven has.”

Alongside legislation passed last year providing additional revenue streams to cities, New Haven’s state lawmakers have attempted to add S.B. 413 and S.B. 414 to this year’s toolkit.

The endowment tax bill entered the national spotlight after a public hearing in front of the state’s finance committee March 22, only to be shot down by the Malloy administration a week later.

Still, Looney noted that the bill — which would have been the first of its kind — served to generate discussion on a new issue, which might bolster similar bills in future years in the state.

S.B. 413, which is backed by New Haven’s state lawmakers, arrived in the midst of a Congressional investigation of the 56 universities and colleges with endowments of $1 billion or more. In February, the Republican-led Senate Committee on Finance and House Committee on Ways and Means sent a letter to the schools, requesting detailed information on the management and use of their endowments.

Harvard University recently released its response to the inquiry, stressing that its tax-exempt status benefits the institution’s teaching and research functions. Harvard’s response noted that $175 million was dedicated to undergraduate financial aid in the last fiscal year, made possible by its $37.6 billion endowment, 84 percent of which consists of restricted gifts.

Similarly, about 75 percent of Yale’s $25.6 billion endowment is restricted. On April 1, Yale made public its response to Congress regarding the endowment.

In public testimony March 22, Associate Vice President for Federal Relations Richard Jacob contended that the bills are unconstitutional given the University’s right to nontaxation as established by its 1701 charter. At the end of the month, Vice President for New Haven and State Affairs Bruce Alexander ’65 emailed Yale alumni who live in Connecticut, asking them to share their potential concerns about the bills with lawmakers.

Alexander published an op-ed in the Hartford Courant Saturday, claiming the bills could drive potential investors from the state.

“The proposed bills, raised at the request of Yale unions and advocacy groups to promote graduate student unionization, reflect short-sighted politics,” Alexander wrote.

Members from Local 33 — the union formerly known as the Graduate Employees and Students Organization — and analysts from the union coalition UNITE HERE testified in favor of both bills March 22.

Yale began its four-year contract negotiations with Locals 34 and 35, which represent the University’s workers, in mid-March. The University does not recognize Local 33.

Looney deferred from attributing the bills to union pressure, saying they arose from the city of New Haven, the Connecticut Center for a New Economy and the city’s state delegation. Leaders of Locals 33, 34 and 35 could not be reached for comment Monday evening.

While S.B. 413 has met a dead end, Looney said it had been mischaracterized as an attack against the University. Instead, he said, the bill was intended to incentivize the University to increase endowment spending for purposes of education, general municipal assistance and local economy-building.

S.B. 414, which Malloy has not commented on this legislative session, has been backed by Harp and the Board of Alders.

The property tax bill resembles a similar bill supported by Rep. Pat Dillon MPH ’98, D-New Haven, in 1990. Dillon told the News that her investigation of the University’s tax-exempt property that year led her to become involved in the legislation, which the General Assembly did not pass. Dillon said the city instead used the bill as leverage for yearly voluntary payments from the University. Yale has made over $96 million in voluntary payments to the city since 1990.

Looney defined S.B. 414 as “an issue of great complexity,” noting that the University pays taxes on its commercial property. Instead, Looney said, the bill focuses on the line between academic research from the University and research which begins to have commercial purposes.

“That’s what that bill is about — to sort of update the concept of tax exemption, and to look at what standards should be applied in that regard,” Looney said Monday.

The University has ties to a number of local biotech companies, ranging from the newly relocated pharmaceutical company Alexion to startups like Proteolix and Arvinas, both established by molecular, cellular and developmental biology professor Craig Crews.

Correction, April 5: A previous version of this article misstated that the University had not released its response regarding the endowment to Congress. In fact, that letter was released April 1.