Together with a Swedish pension fund and United Steelworkers, the largest industrial labor union in North America, a handful of undergraduates at Dwight Hall are confronting the oil and gas corporation ExxonMobil on an issue central to campus’s divestment debate: shareholder engagement.

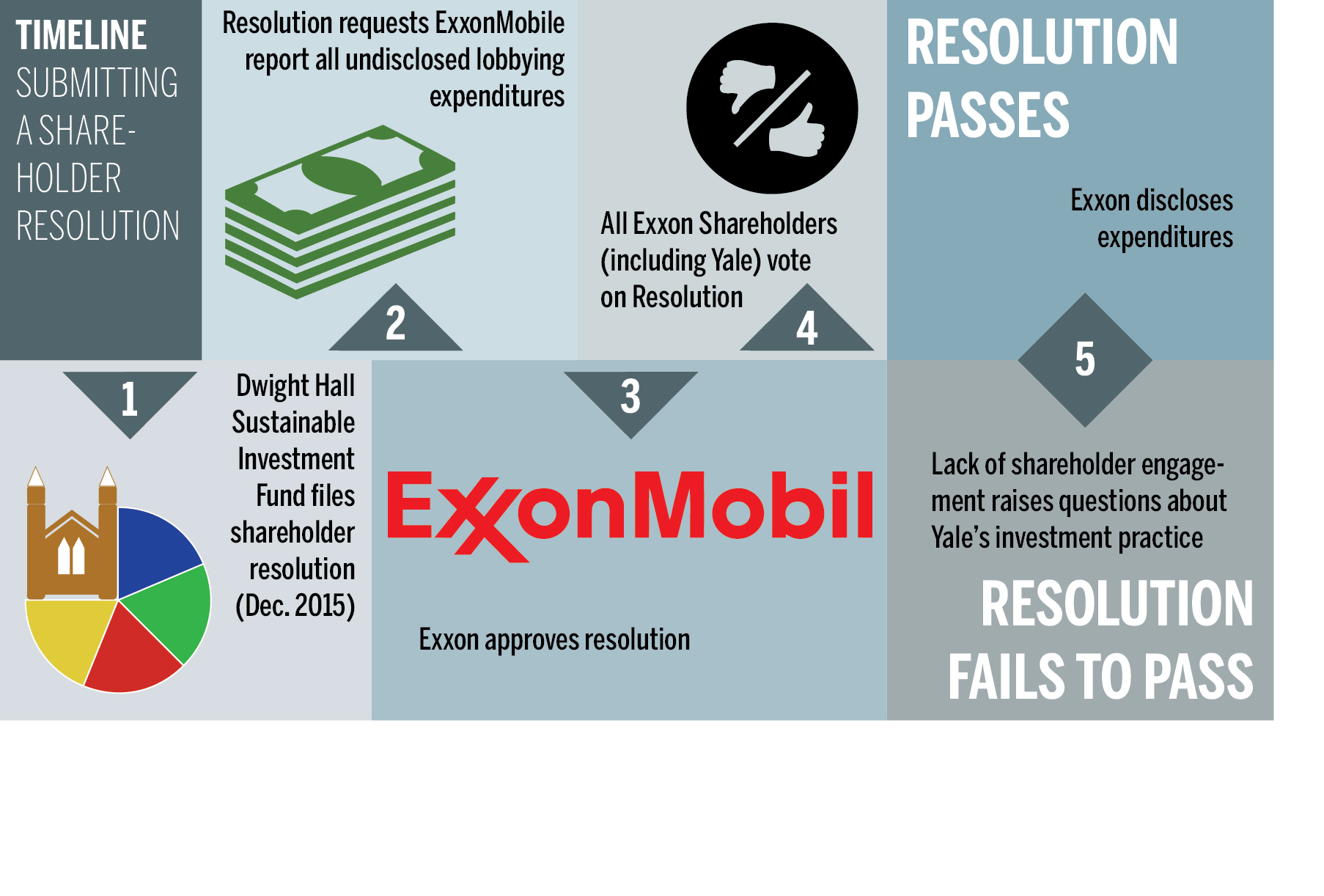

On Sunday, the Dwight Hall Socially Responsible Investment Fund — an undergraduate group that aims to find the most ethical and responsible investment practices — became the first student-led fund nationwide to file a shareholder resolution, a request made by shareholders to vote on the direction of a company. The resolution calls on Exxon to publicly report its undisclosed lobbying expenditures. Climate activists have criticized Exxon for lobbying against the scientific community to downplay the threat of climate change. Around $2,000 of the Dwight Hall SRI Fund — which totals approximately $100,000 — was invested in ExxonMobil in 2014, the minimum amount required for filing a shareholder resolution with Exxon.

Yale is also an investor in Exxon, though the University has not disclosed the size of its stake in the company.

If all of Exxon’s shareholders vote the resolution down and refuse to disclose the company’s expenditures— and SRI members said they expect they will — Yale may come face to face with its own investment rules, which have recommended since 1972 that the University divest from companies where shareholder engagement no longer works. Exxon also has the power to prevent a resolution from even getting to a vote in the first place.

“Exxon is under a lot of fire … because of misinformation that they have actively disseminated,” said Daniel Tenreiro-Braschi ’19, a Dwight Hall SRI member. “It’s kind of an opportune moment for the company to look at itself.”

Before the resolution faces a vote in May, it must first be made legitimate by the Securities and Exchange Commission, a federal agency that oversees national stocks. All shareholders in a company would vote on such a resolution, with the number of votes relative to the size of a shareholder’s stock. When the resolution finally goes to a vote, Dwight Hall SRI members said they expect Yale to vote in favor of Exxon disclosing its lobbying expenditure.

Jonathan Macey, chair of Yale’s Advisory Committee on Investor Responsibility, said in a statement Sunday that the ACIR is committed to voting for resolutions that are consistent with the reality of climate change. Macey added that he would encourage the ACIR to support Dwight Hall’s shareholder proposal, if Exxon allows a vote to move through.

When a similar resolution requesting lobbying disclosures was filed with Exxon by another group of shareholders last year, it failed to pass. SRI member Gabe Rissman ’17 said that if the current Dwight Hall SRI resolution fails to pass, even despite a potential affirmative vote from Yale, Fossil Free Yale would have more leverage when arguing for Yale to divest.

“If Yale votes its shares and then the measure fails, that … kind of proves [Yale] wrong and gives weight to the divestment argument,” said Russell Heller ’19, a member of the SRI fund. “It’s not super likely that it’s actually going to pass. [Yale is] going to have to revisit their entire ethical guidelines.”

Those guidelines were first outlined more than four decades ago in “The Ethical Investor,” a manual that sketches the “ethical, economic and legal implications” of Yale’s investments. An excerpt from “The Ethical Investor” states that the University will sell its stock in a company if it is unlikely that shareholder engagement will successfully improve a company’s activity. Put simply, the document requires that if shareholder engagement with a company fails, Yale must divest from that company.

Heller drew a distinction between the respective approaches of FFY and the Dwight Hall SRI Fund in pushing for divestment. While both student organizations share the same ultimate goals of climate-friendly investment, Heller said the SRI fund is approaching divestment through more legislative methods, going through the bureaucracy rather than demanding that the University immediately divest.

The Dwight Hall SRI Fund co-filed the resolution in December 2015, and waited until Sunday to publicly announce the filing, Tenreiro-Braschi said.

Exxon has been embroiled in recent months in scandals uncovered by The Los Angeles Times, the Columbia Journalism School and InsideClimate News. The news organizations found that Exxon may have intentionally obstructed government efforts to fight climate change. Exxon is also now being investigated by the state attorneys of both New York and California for lying to its shareholders.

Furthermore, the Dwight Hall SRI announcement claimed that Exxon is a member of several organizations known to obstruct climate policy efforts, including the American Petroleum Institute and the National Association of Manufacturers.

Heller said Exxon lobbies through many trade organizations, but that much of this lobbying is hidden from the public eye.

“It’s very unclear as to how much money they give,” Heller said. “Legally they’re allowed to lobby, but the way they do it is behind closed doors.”

Before Exxon shareholders vote on the resolution, Heller said Dwight Hall SRI members will talk over the phone with Exxon officials. Exxon is expected to offer to “settle” the case without putting it to a vote, but Heller said his fellow members at Dwight Hall will stand firm and refuse to compromise.

“We’re talking with them and waiting,” Heller said.

Founded in 1886, Dwight Hall is a nonprofit umbrella organization comprised of 90 member groups.