While Yale posted a 4.7 percent endowment return in the fiscal year that ended June 30, 2012, most other colleges saw almost no change in the size of their endowments, according to the 2012 NACUBO-Commonfund Study of Endowments.

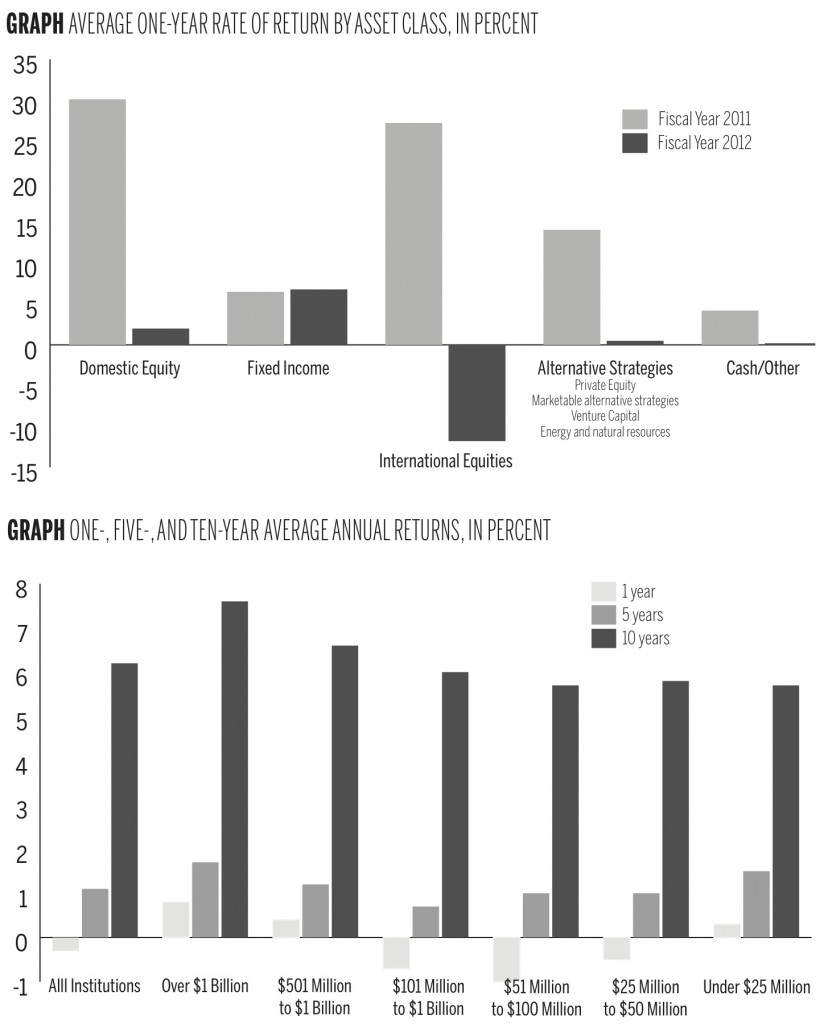

Released today, the study indicates that Yale’s endowment fared well compared to other U.S. college and university endowments in the latest fiscal year. The 831 institutions represented in the study saw an average return of -0.3 percent in fiscal 2012 — a sharp drop from the 19.2 percent average return they reported in fiscal 2011. Experts interviewed attributed lower endowment returns largely to lackluster financial markets last year, which they said suffered in part because of the debt crisis in Europe, but have already begun to rebound in fiscal 2013.

“Many endowments are still in recovery mode from the credit crunch in 2008,” said Andrew Karolyi, a finance professor at Cornell University, adding that most asset classes, including Yale’s favored alternatives, “did not have a banner year.”

Endowments valued at over $1 billion yielded an average return of 0.8 percent last year — a figure William Jarvis ’77, managing director of the Wilton, Conn., investment firm the Commonfund Institute, said helps set Yale’s performance in context. Though a return of 4.7 percent is significantly lower than Yale’s 21.9 percent endowment return in fiscal 2011, Jarvis said Yale’s performance last year was “actually quite respectable.”

Schools with larger endowments can take more investing risks, said Matthew Spiegel, a finance professor at the Yale School of Management, because they can afford to “gamble a bit more” in the hopes of earning a higher return. While smaller endowments saw higher returns than larger endowments during the recession because they were less heavily invested in alternative assets, larger endowments have begun once again to outperform their smaller counterparts, the study said.

Alternative assets as a group generated an average return of only 0.5 percent in fiscal 2012, according to the study. Despite their tepid performance, universities nationwide allocated an average of 54 percent of their endowments toward alternative assets, up from 53 percent in fiscal 2011. International equities produced the lowest returns, at -11.8 percent in the latest fiscal period, while fixed income saw the highest returns with an average of 6.8 percent.

Though larger endowments like Yale’s saw the highest results, fixed income is not an asset class favored by Yale’s endowment, which leans heavily toward more risky investments like private equity and hedge funds.

Spiegel said that fixed income, which includes government bonds, generally sees lower returns than other asset classes on an average year because it is a low-risk investment. The higher returns from fixed income are not indicative of an underlying trend, and are merely the result of governments and federal banks distorting markets in an effort to “sustain the global economy,” Jarvis said.

Experts said markets have looked more promising in fiscal 2013, which Jarvis said has been characterized so far by rebounding public equity performance and the “rotation out” of fixed income. Still, Jarvis noted that it is unclear whether Yale’s endowment will see better results this year since Yale has not heavily invested in either of those asset classes.

Prior to the onset of the economic recession in 2008, Yale’s investment model propelled the endowment to returns of around or above 20 percent during the “boom years” of the mid-2000s. Jarvis said it is possible that the era of exceptional endowment returns ended with the financial crisis, adding that universities could be entering a period of more “subdued returns.” He said more modest returns in recent years have proved challenging for many universities.

“They’re absolutely struggling,” Jarvis said. “When you’ve got a flat year when the endowment does not increase and you’re still spending at 4 to 5 percent, that’s a real challenge.”

But the trend toward alternative assets, pioneered by Yale’s Chief Investment Officer David Swensen as early as 1990, “has not peaked yet,” said Jarvis. Newly appointed Provost Benjamin Polak said Swensen’s investment strategies have become “the gold standard for how to manage endowments,” so much so that it has become harder to beat the market because so many managers are using the same methods.

Over the long term, college endowments have still performed better than most market indexes, the study showed, citing an average return of 6.2 percent over the past 10 years for endowments compared to a 5.6 percent return for the S&P 500 index.